Between 2009 and 2013 (the hardest period during the on-going crisis), credit to the public administrations grew at 14% and 36%, whereas credit to the Spanish households was in contraction from the very beginning of 2010.

The following chart from the Bank of Spain shows the development of the banking credit to businesses and households in November. The clear conclusion is that it keeps on falling at -4.6% and -5.2% annual rates respectively (columns 6 and 7).

Credit to the public sector continues above 16% annual, which implies a deceleration from the 20% reached in 2012. The chart below shows a comparison between credit for the private and public sectors:

Even though there is a certain deceleration in the fall of credit to businesses and households, the fall rate is still very high.

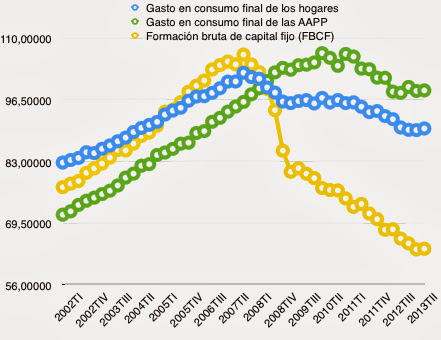

Can we talk about “crowding out” from the public sector to the private one? I don’t think so. We can talk about insufficient banking money supply. Actually, credit to the public sector could be a driving force for expenditure. As a matter of fact, the recovery signs we currently see are in the public expenditure (mainly in consumption), which seems to have encouraged the private consumption. However, both public and private investments give no sign of life (as seen in the chart).

The Spanish regions with more difficulties to obtain credit are La Rioja, Canarias, Castilla y León and Galicia. On the other hand, Catalonia, Madrid and País Vasco found it easier (though not much) to ask for a credit.

Be the first to comment on "In Spain, Credit To Businesses and Households In Free Fall"