The process of restructuring Spain’s banking sector continues its course. According to that established in the Memorandum of Understanding (MoU) for financial aid, on 31 August the Spanish government passed a Royal Decree-Law on the restructuring and resolution of credit institutions. This regulation contains the special instruments that should be used in the crisis management of credit institutions, among these being the creation of an Asset Management Company (AMC), also known as a «bad bank» or Sareb.

After the publication of the stress test results to determine the capital requirements of each institution, the bank restructuring process will now enter its next stage.

According to the road map established in the MoU, from now on efforts will be concentrated on determining the viability of the weak banks. Those institutions which have already received state aid (banks from Group 1) and those that need to receive this aid (banks from Group 2) must present plans for restructuring or ordered resolution that tackle the capital deficits detected in the stress test.

These plans must be approved by the European Commission as a condition for bail-out funds to be paid. At the same time, any toxic assets from those banks requiring state aid will be segregated and transferred to Sareb.

Given the uncertain situation concerning the capital requirements of Spanish banks, debate has now arisen regarding the loss of deposits by Spanish banks. According to data published by the European Central Bank (ECB), the deposits held by Spain’s banking system fell sharply by 71.2 billion euros in the month of July, with the amount of deposits lost since July 2011 totalling almost 232 billion euros.

These figures have set alarm bells ringing regarding the possible «flight» of deposits. However, a detailed analysis shows that these statistics are designed for the ECB’s monetary analysis and do not strictly reflect banks’ balance sheets.

The deposit figures published by the Bank of Spain a few days later indicate that most of the withdrawals of deposits from Spanish institutions, specifically 61%, are due to the decrease in repos carried out via central counterparties and to a contraction in deposits with depository corporations and securitisation funds.

These operations are of a monetary nature and do not reflect the withdrawal of deposits by firms or households. In fact, the ECB has announced that, as from next month, its monetary statistics will be adjusted by these items in order to provide more reliable information for external users.

Having discounted this effect, the year-on-year growth in July for sight deposits of households and firms stands at -0.4% and -12.7%, respectively. One factor that helps to explain the fall in household and company deposits is the replacement of these by commercial paper. High yield deposits were penalised via a greater contribution to the Deposit Guarantee Fund. This led to around 30 billion euros being issued in commercial paper, offering more attractive returns. However, the elimination of this penalisation on 31 August suggests that less commercial paper will be issued and bank deposits will pick up again.

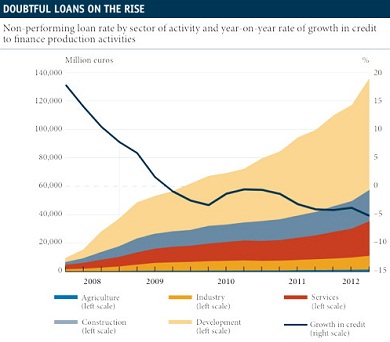

Bank credit to the private sector fell by 3.4% year-on-year in July, probably affected by the deterioration in loan portfolios and the weak Spanish economy. A breakdown by end purpose shows that credit is shrinking in all branches of activity. Also of note is the drop in credit to households to buy consumer durables, indicating families’ poor purchasing power.

The data on doubtful loans place the non-performing loan (NPL) rate for Spain’s banking system as a whole at 9.7%. This rate rises to 14.9% for loans to resident sectors in order to finance production activities. As can be seen in the graph above, real estate (developers) and the construction sector concentrate most of these non-performing loans. However, there has been a notable rise in the NPL rate for the services sector and, in particular, those of hotels and restaurants and those of transport, storage and communications.

This is particularly significant as it shows that credit problems are not limited to sectors related to construction but rather that fragility is spreading to all areas of business.

In summary, over the coming months Spain’s banking sector will be sorted out for good. This will be crucial in order to dispel doubts regarding the solvency of Spanish institutions. Spain’s financial system is therefore expected to have strong, recapitalized institutions by the end of the year.

Be the first to comment on "Spanish banks with capital deficiencies initiate their viability plans"