Financial analysts in Madrid warned that a ban on short selling would depress trading volumes even further while solving very little in terms of investor confidence recovery. At The Corner, we faithfully reported their disappointment with the authorities, whose small sticking plasters of policies would leave structural problems untouched, in most experts’ opinion.

In the short term, though, there was something to look forward to.

“Bankinter Broker and Afi experts gave a hint away: as soon as the ban was decided, the Spanish index Ibex 35 stopped its 5 percent downturn and recovered four percentage points, even if it didn’t leave negative territory.”

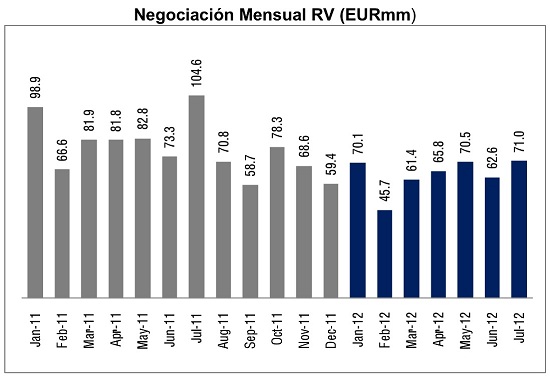

The latest data offered by the Spanish stock markets operator BME confirms the immediate effect of cancelling short selling activity. Equity trading rose by 13.5 percent in July versus June this year. Year on year, the figure remains negative at an staggering -32 percent.

Even so, financial reports on Thursday admitted BME numbers were better than forecast and opened the door to the option for listed companies to promise extraordinary dividends charged against 2012 results. Where is the reason for such upbeat mood? Here: equity market monthly trading in billions of euros.

Be the first to comment on "Thursday’s chart: Spanish stock market operator data better than expectations"