There is no denying that the talk of an eventual Spanish national rescue by euro funds has now become a feature in any serious discussion about what’s next for the global economy.

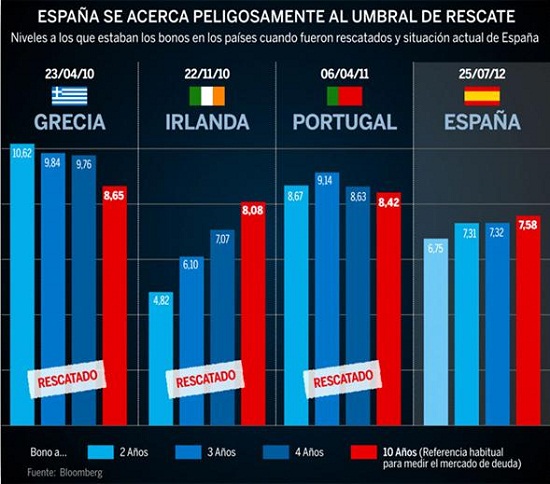

Even though always ready to confront but not conform to the most realistic conclusion market analysts find for Spain, the country’s president Mariano Rajoy admitted last week that a complete bailout appears on the table next to all options that could help “Spaniards’ general interests.” The financial City of Madrid thinks that much, too, as reports on Wednesday piled up over evidence that the Spanish government’s access to international credit rapidly approaches the yield threshold other rescued States went through before.

Some experts, at Renta 4 for instance, consider that the cost of market credit is indeed the line to watch, as opposed to the risk spread comparing to German bunds in the 10-year category.

“The risk premium is meaningless in order to check a country’s probability of default,” a Renta 4 note said. “It is absurd to compare interest rates to German bonds’ because when Greece, Ireland or Portugal were rescued the German yield was 1.48 percent or almost double that of today.”

The current pressure on 10-year Spanish debt, at about 6.9 percent, is deemed unsustainable by most observers when adding that maturities this year amount to €63 billion and €118 billion in 2013 (Bankia Bolsa calculations are higher, €90 billion and €140 billion, respectively). How long can Spain stand this price?

The only exit president Rajoy has been showed from this agonising wait points at a full bailout. The governor of the European Central Bank Mario Draghi recently suggested buying sovereign bonds and monetising debt, that is, engaging in those money printing programmes in which the US Federal Reserve and the Bank of England have incurred several times since the Lehman Brothers bankruptcy in September 2008… if Madrid officially asks for a national rescue.

The obstacle for this to happen, of course, is called austerity. Or further austerity, as Madrid would put it, after having introduced reforms in the labour market, the banking sector and more stringent fiscal policies.

New debt issuance would raise government financing costs by between €4.2 billion and €5.8 billion, according to Madrid reports. But in 2012, the average yield to pay still is 4.4 percent. Madrid could have more muscle to force a softer treatment from Brussels than perhaps the opposite negotiating party would prefer.

Be the first to comment on "Wednesday’s chart: Spain approaches bailout zone yields"