How many NPLs in the Greek banking sector are also non-recoverable loans?

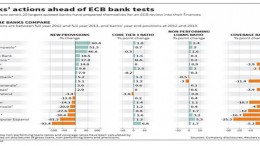

ATHENS | By Jens Bastian via MacroPolis | The recent presentation of half-year results by the four systemic banks in Greece – National Bank of Greece (NBG), Piraeus Bank, Alpha Bank and Eurobank – brought a mixture of good news and underlying structural challenges affecting the operational capacity of domestic lenders.