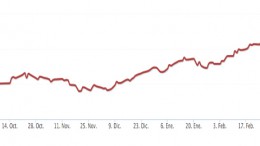

Spain’s Top Banks H1 Earnings Boosted By Lower Provisions

Spain’s top five banks posted a combined net profit of 7.989 billion euros in the first half of 2015, up 48 percent from a year earlier, thanks to the improving economic situation and a decline in bad loans provisions.