After the stress tests, are there further national consolidations ahead?

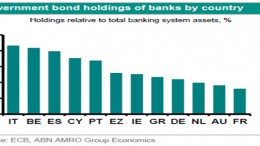

BRUSSELS | By Alexandre Mato | The outcome of the stress tests led by the ECB and EBA showed that there are important weaknesses in the Italian and Greek financial sectors. 7 out of the 13 institutions that had to raise capital come from both countries. Perhaps, the era of restructuring are not yet behind us and the sector needs still more integration.