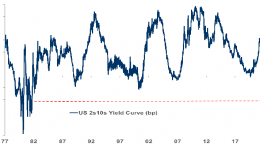

Market sees recession: 2/10 year US bond curve inverted by more than one percentage point for first time in 40 years

Ana Racionero (Intermoney) | A Fed rate hike to 6%, a level whose risks have long been hedged in the options market, is starting to look less and less far-fetched. Powell’s appearance before the Senate yesterday unleashed a tsunami that sent bonds on both sides of the Atlantic tumbling, causing traders to recalibrate rate levels. The swap market raised the interest rate for the Fed’s September meeting to 5.60% and,…