Germany 2015: Some happy news, yet not enough to revive eurozone’s growth

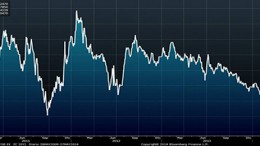

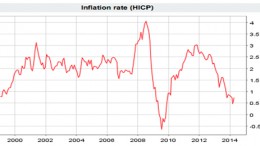

BERLIN | By Alberto Lozano | The German economy has gone from growing at 0.8% q-o-q earlier this year to being on the verge of recession as a result of the geopolitical situation, especially after the sanctions against Russia. Only now in December the country seems to recover its confidence. However, an expected GDP growth of around 1% in 2015 continues to be insufficient to spur growth in the Eurozone.