Monetary policy- the way we were (without revisionist history)

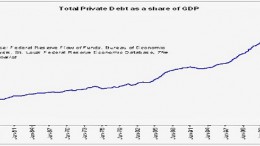

SAO PAULO | By Benjamin Cole via Historinhas | Sadly for Americans, the Fed of 2008 would pull out the 50-year-old playbook and repeat the mistakes of the Fed of the 1950s. Rattled by minor increases in prices, the 2008 Fed stomped on the brakes, bringing on the Great Recession from which the nation has yet to fully recover.