Is Leaving Everything To The Central Banks A Good Idea?

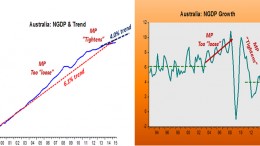

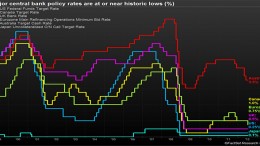

The markets sway to the rhythm of the central banks, but it’s not clear that monetary policy alone can solve the serious economic problems affecting most of the planet. Perhaps it would be a good thing to take heed of Summers idea that it is preferable to back productive investment and not the creation of bubbles supported by low interest rates.