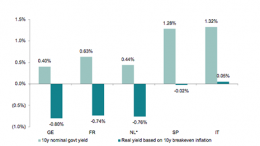

EU data shows signs of recovery

The Corner | March 25, 2015 | EU data appears to show that the currency bloc is finally on the way to recovery. Figures from Spain today are likely to confirm the country’s improvement, but concerns remain about the predicament of the Greek economy.