Europe needs tail wing- ECB willing to open windows

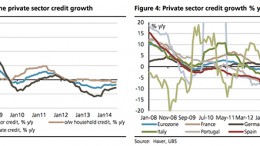

MADRID | By Jaime Santisteban | After successive quarters of economic expansion, increased demand and rises in industrial production which had triggered widespread optimism, the economic recovery has lost momentum in the Eurozone, halting abruptly in Q2. That was the main message conveyed on Monday by Mario Draghi at the European Parliament. Weak credit growth may prove an obstacle to recovery, and the continued lag in this sector is likely to persist for the rest of this year, with gradual increases in lending expected in 2015 and 2016.