ECB’s Praet: TLTRO will break the lack of credit’s vicious circle

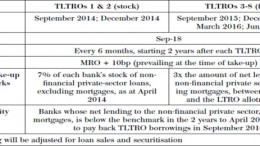

MADRID | The Corner | Upcoming TLTRO in Sept 18 and Dec 11 will allow EZ banks to borrow an amount equivalent to 7% of what they currently lend to the private sector at 0.25% a year (excluding interbank loans and mortgages), breaking the vicious circle of high lending rates to companies, high credit risk and a sluggish economic performance, European Central Bank’s chief economist Peter Praet said on Wednesday.