Why Greece is asking for 1.2 bln back from the EFSF

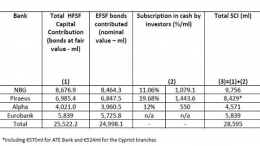

ATHENS | March 30, 2015 | By Manos Giakoumis via MacroPolis | Following the Eurogroup decision on February 20, Greece returned 10.9 billion (European Financial Stability Fund) EFSF bonds at the end of the previous month. That transaction reduced accordingly the country’s debt and the debt to GDP ratio by more than 6 percentage points.