Emerging markets = Investors’ Achilles heel

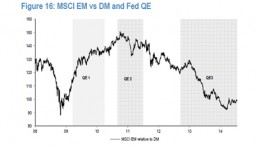

The Corner | March 11, 2015 | The market still points to emerging markets as one of the most vulnerable areas in the global economy. The absence of a rebound in the price of commodities (despite oil’s recent revaluation) is hampering these countries’ economic recovery.