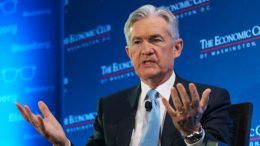

Jobs and growth data won’t deter the Fed’s resolve

J.P. Marín-Arrese | Last Friday, Wall Street jumped on employment and services data. Jobs openings, while better than expected, signalled a downward path. The service sector contracted for the first time till 2020. The ensuing bullish reaction shows the markets bet the Fed might undertake a U-turn earlier than pointed out in the last FOMC minutes. Investors seem to outwit the Fed, disregarding its determination to keep rates tight enough…