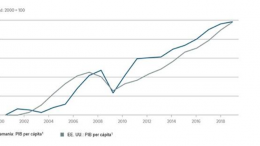

In terms of growth per capita, USA and Germany have grown exactly the same since the beginning of this century

DWS | After experiencing a slight fall during the second quarter, German gross domestic product (GDP) grew at a slightly positive rate in the third quarter of the year. This means that Germany has been spared, by the hair, of falling into a technical recession. However, it is likely that the most recent data fail to reassure skeptics.