Peripheral Europe’s bond rally might soon come to an end

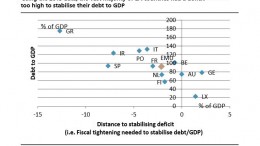

MADRID | The Corner | Peripheral equities and bonds have been strongly favored by Draghi’s speech last Friday at Jackson Hole with intense improvements in sovereign credits from Portugal, Spain and Italy, which have reached record lows. In particular, Spain’s 10-year bonds yields are at 2.12% under the 2.38% of comparable U.S. Treasuries and especially today the Spanish Treasury has reduced sharply the interest rates of three- and nine-months bills in an auction of € 3,500 million at historical lows, without entering in negative territory like on the secondary market. Nevertheless, UBS strategists are starting to change their bullish view on peripheral Europe basing on market and fundamental arguments.