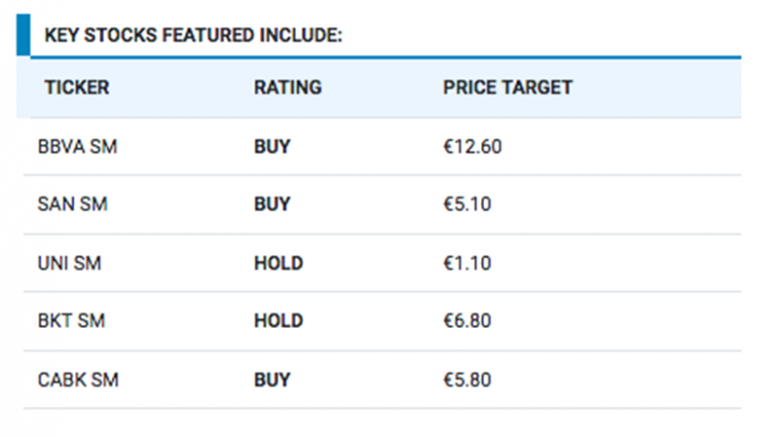

Spanish Banks 1Q24 | What to Watch for?

Jefferies Equity Research | Spanish Banks’ 1Q24 earnings season kicks off later this week. We expect focus to remain on the NII print/guidance in a context where rates expectations have moved up YTD. Loan growth still not helping, but in-check asset quality is an offsetting factor. Outside Spain, Mexico’s numbers came relatively solid into early Q1 24 as per CNBV data. In Brazil, loan growth is now flat in real…

Read More