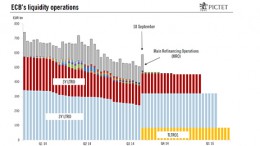

ECB: Tomorrow, March 27th, the last big maturity (€216 billion) of the TLTROs

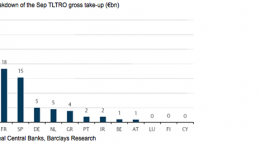

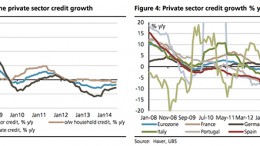

Banca March: tomorrow, March 27th, the ECB and European banks will face the last large maturity of the TLTROs (“Targeted Longer-Term Refinancing Operations”) for an amount of approximately €216 billion. According to our estimates, this maturity will represent a reduction in the balance sheet of around -1.6 p.p. in terms of GDP, and will leave an outstanding balance of €177 billion (8% of the programme’s initial amount). It is important…