Michelle Meyer & Alexander Lin (BofA Global Research) | The May jobs report was nothing short of stunning. We will review the numbers, discuss the reasons why we think there was such a surprise and address implications for our forecast.

1. May nonfarm payroll growth was +2.5mn versus consensus expectations of -7.5mn.

2.The unemployment rate fell to 13.3% versus expectations of a pickup to 19%.

3. Evidence of rehiring those who were temporarily unemployed: those on temporary leave fell by 2.7mn to 15.3mn, aſter 18.0mn in April. Along the same vein, those who were unemployed less than 5 weeks decreased by 10.4mn to 3.9mn.

4. Where was the job growth concentrated? Restaurants added +1.4mn jobs, boosting overall leisure & hospitality. Construction jobs returned with a gain of 464k, reversing nearly half of the peak-trough decline in jobs in this sector. Health care employment increased 312k, retail was up 368k and manufacturing rose +225k.

5. Any job cuts? Government was the bulk of the job cuts at -585k, driven by reduction at the local level. This speaks to the stress on state and local budgets. There were also modest cuts in mining, utilities, information.

How do we explain the huge miss in the forecast?

1. The consensus forecasts were based on the claims data, which revealed continued job cuts and a net 3mn increase in continuing claims between survey weeks. It is possible that there are timing issues as the backlog of claims is processed. Moreover, some states allow people to receive benefits even if they are employed but their hours are significantly reduced.

2.The Payroll Protection Program (PPP) may have pulled forward rehiring as small businesses allocate funds toward workers. Remember in order for the loan to be forgiven, 75% of the funds must be used for payrolls (although that requirement is set to change).

3.The BLS may have calculation issues surrounding the birth/death adjustment. Every month the BLS has to make an assumption of how their sample might be changing. They assumed job creation from business births of +345k this month aſter only -553k last month from business destruction. That is pretty modest.

4. And finally, perhaps the recovery is indeed stronger than we had assumed. The reopening has been earlier and consumer sentiment has seemingly improved more quickly. We have also see a notable turnaround in the spending based on the aggregated BAC card data.

What does this mean for our forecast?

The labor market recovery started a month or two earlier than expected, therefore suggesting a V-shaped trajectory in the early stages of the recovery. We have now learned that a total of 22 million jobs were lost in this recession and the unemployment rate peaked at 14.7%. But it decidedly does not mean that the V-shaped trajectory will continue into the later stages of the recovery. We remain concerned about the health of the economy aſter the initial jump higher from reopening and are concerned about risks posed from the virus and many millions of displaced workers.

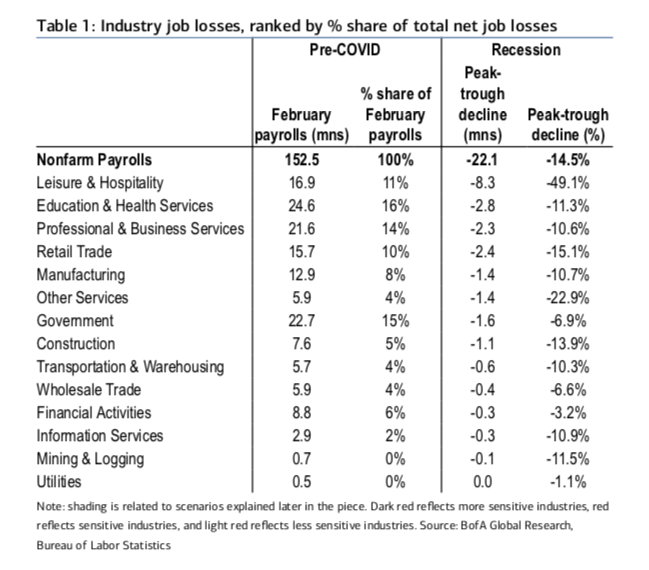

We believe an effective way to forecast in this environment is to look at the economy from a bottom-up perspective. In Table 1, we set the stage with the share of jobs pre-COVID and the peak-trough declines during this recession. Leisure & hospitality jobs declined 49.1%, representing the biggest driver of the cumulative decline in the broad labor market. This means the recovery in this sector will be – by far – the most important swing factor for the recovery. This is followed by education & health services, professional & business services, and retail trade.

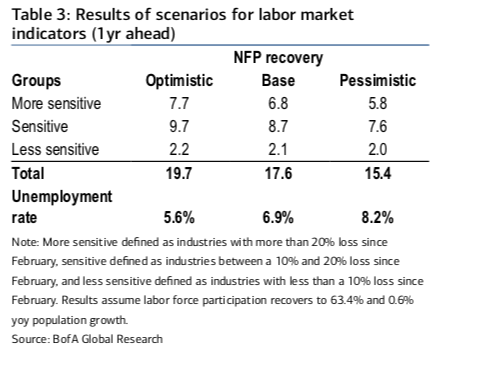

As a starting point, we run a variety of simulations for the unemployment rate over the next 12 months (middle of next year) under different degrees of recovery. We divide the sectors into three categories based on sensitivity to the COVID shock and plug in different recovery rates. This allows us to derive a matrix for the jobs recovery and therefore the unemployment rate (Table 3). For simplicity we assume the labor force participation rate returns to pre-COVID levels (but more on this later). Across our optimistic, base, and pessimistic scenarios for recovery rates, the unemployment rate falls to 5.6%, 6.9%, and 8.2% by the middle of next year. The table emphasizes the challenges in getting the unemployment rate to fall absent a fast recovery in the most COVID-sensitive sectors.

Focus on leisure & hospitality

The leisure & hospitality sector, which includes hotels, restaurants, and recreational activities, is the focal point. In our baseline forecast, we assume a recovery to 70% of payrolls by the middle of next year.

Hotel occupancy rates will be a function of business travel and tourism and neither are likely to see a quick return to health. Businesses have adapted to the pandemic with a massive shiſt to work from home and teleconferencing, and part of this shift will likely be permanent even aſter the pandemic is over. Consumers will be more likely to stay at home, not only to minimize the risk of infection but also given the damage to the labor market and household confidence, weighing on tourism. Reflecting these challenges and many more, our US Lodging Analyst Shaun Kelley believes Revenue Per Available Room (RevPar) will return to 70-80% of normal levels by the middle of next year, which would support a 60-70% recovery in jobs – in line with our baseline.

Meanwhile, social distancing policies are likely to stay in effect in a reopened economy. This will mean that restaurants and many kinds of recreational activities such as theaters, amusement parks, and spectator sports will be unable to operate at full capacity. Restaurants have been able to offset some of the hit to traffic through greater online deliveries, but the end result should be reduced demand for labor and therefore a slower recovery rate for the broad leisure & hospitality industry.

Disclaimer: the labor force participation rate assumption matters

The simulations above focus only on the path of rehiring. We are not making an assumption for movement of people in and out of the labor force. To keep it simple, we are assuming that the labor force participation rate returns to pre-COVID levels, at least initially upon reopening. If there ends up being more displaced workers who exit the labor force, the unemployment rate will be able to fall more quickly. But this, by itself, would be discouraging since an exit of the labor force ultimately means less productive capacity in the economy. In other words, a drop in the unemployment rate because of a decline in the labor force would be for “bad” reasons.

What does it mean for the Fed?

This has bought the Fed some time. At the upcoming meeting, the Fed is likely to still sound cautious but with some underlying optimism that the recovery has begun. We have been arguing that the Fed will be “on hold” for the next few months as they access economic conditions. We still think this is the case. By late summer/early fall, the Fed will have a better understanding about the scars on the economy from the deep and sudden recession. We have been calling for the Fed to implement the next round of stimulus at this point, which would include stronger forward guidance and short-term yield curve control (YCC). Of course, if the recovery ends up being more persistent and robust, they might not need to take this step. That said, the Fed has – and will continue to – lean in the direction of being too easy rather than less so. They have embraced the idea that it is better to do more than fail to do enough with deep regrets.