Most economists were probably expecting a fairly easy ride at the beginning of 2020. However, unforeseen exogenous events such as the outbreak of China coronavirus are standing in the way, generating a high level of uncertainty. In the opinion of Gilles Moëc , Chief Economist at AXA IM, that now “ economic policy could be on autopilot is not very consensual”.

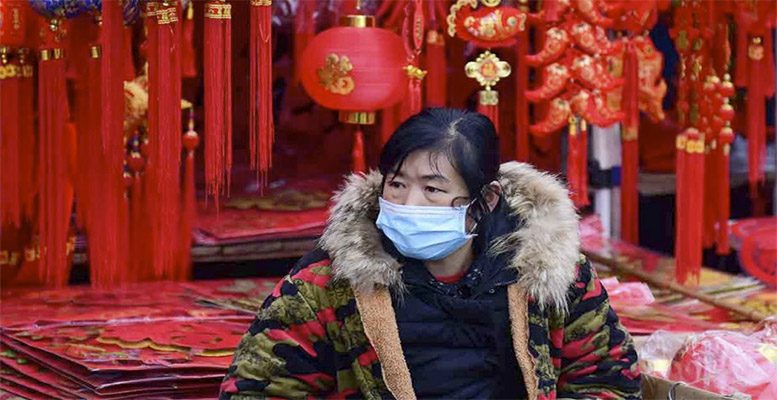

Escalation in the Middle East was absorbed swiftly (for now), but the global economy now needs to deal with another epidemic originating from China.

“It is far too early to risk any quantification of the economic impact of the current coronavirus crisis, but faced with non-linear shocks such as this one, the reasonable first approach is to look for precedents. A 2004 paper which we found quite thorough in its methodology suggests the 2003 SARS crisis lowered GDP by 1.1% for China (very close to the assessment of the current crisis S&P disclosed last Thursday) and 2.5% in Hong Kong, but by only 0.1% for the US. “

Note however that since 2003 the weight of China in the world economy has risen significantly, so the spill-over would probably be bigger. But again, at this stage it is impossible to know if this is the right precedent. Contacts between China and the rest of the world have soared in 15 years and the emergence of large scale “autonomous” contagion points outside Greater China would obviously change the equation.

One of the macro consequences we can already draw from the crisis at this stage is that reading cyclical data from China may become very difficult in the coming months. Indeed, if the data flow relapses after its encouraging rebound of the last two months – e.g. if the PMIs dip again – it will be next to impossible to disentangle what is a knee-jerk and probably transitory reaction to the measures taken to contain the epidemic or if the economy is heading south again for more fundamental reasons. Early year data is always difficult to assess in China because of the varying holiday seasonality. It is likely to be even worse this year. As said by Moëc:

“We can’t insist enough on the centrality of the China scenario for the global 2020 macro outlook: whether some rebound can be expected thanks to the fading trade war or if the need to address the domestic imbalanced coupled with the structural headwinds will cap domestic activity is likely to set the tone for global manufacturing cycle. We may have to wait longer to get any hint.”