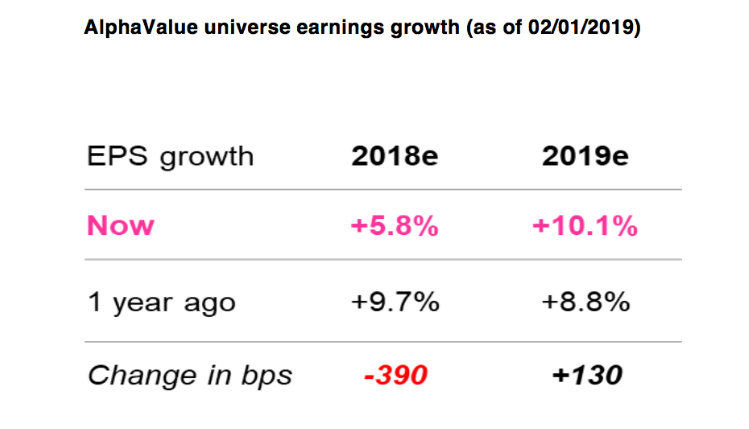

We begin the year with a cheap PER at 12.2 times Ebitda profits. But, according to Alphavalue, everything will depend on whether the demanding estimations of forward BPA are met. “The +10% increase in BPA in 2019 is perhaps too reassuring. Thus we will have to be very attentive to the results for Q418 (and the year 2018) to confirm whether we will really have the feared and probable downward revisions in profits”, the analysts explain.

The following table shows that the growth in profits in 2018 has reduced by about 390 bp to +5.8% compared to the +9.7% foreseen a year ago.

The upgrade for 2019 during the same period (+130bp) should not fool anyone, given that it is dealing with an a “downward” actualisation of profits (base effect) and now it is likely that some of the bad news from 2018 (like slower growth in global GDP) will end the hopes for 2019.

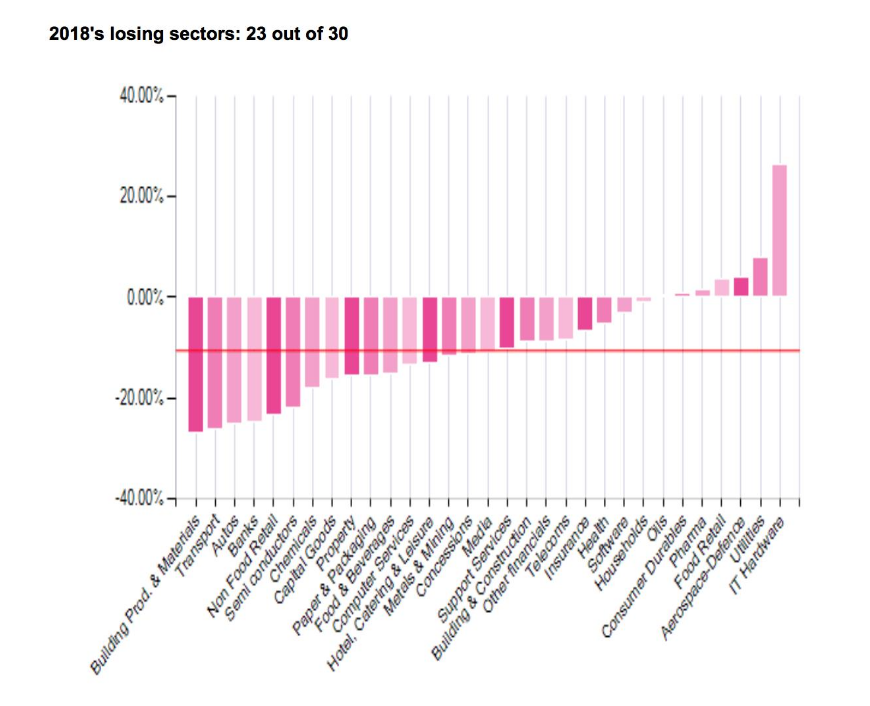

In fact, as Alphavalue’s experts have pointed out in different notes, the sectors which are generating an increase in 2019 profits (financial entities, car sector, insurance, food companies and telecom) are also those which have suffered the most rapid falls in the last six months.

Populist politics are an illusion in the short term which the markets cannot buy for a long time. From Donald Trump, Brexit, Matteo Salvini, to the French yellow jackets, governments are finding it ever more difficult to balance their budgets to the extent that they are facing these kinds of events which are affecting economic growth and fiscal incomes.

This is not an appropriate environment for companies, although the majority, at micro level, seek to find a way of avoiding the consequences.

Alphavalue repeats the contrary opinion and, often effective, that the sectorial disasters in 2018 could be suitable opportunities for 2019. This covers construction materials companies (helped by cheaper energy), transport and automation. Financial entities have not secured any support from their strong dividends, for which reason we maintain some doubts. At the other extreme, and although they have not functioned well until now, the utility comparatively appear expensive.