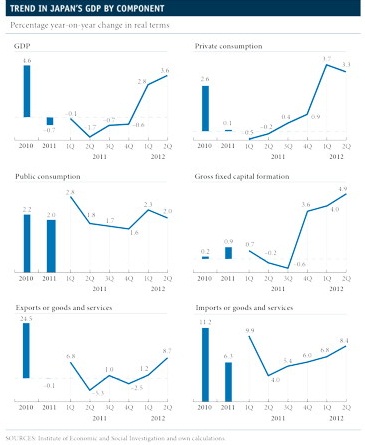

GDP in the second quarter slowed up slightly with an advance of 0.3% quarter-on-quarter, although the base effects due the tsunami in March 2011 took quarter-on-quarter growth to 3.6%. By component, this slowdown supposes a certain return to normality.

Private consumption which, atypically in Japan, had been the engine behind growth in the first quarter, remained practically at a standstill, while capital goods investment swapped its past declines for a 1.5% rise quarter-on-quarter. The public and foreign sectors slowed down considerably, thereby contributing to the deceleration.

The energy shortages due to the nuclear stoppage, and aggravated by the recent rise in oil prices, are causing bottle necks in production.

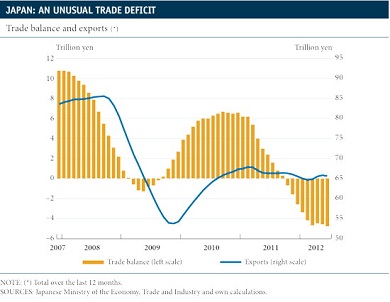

This has two consequences. Firstly, it compromises growth, affecting industrial production and exports, which have been the main engine for growth over the last few years. In spite of its slight upswing in June, the recovery in the industrial production index has come to a standstill at 6.0%, below the level of February 2011, prior to the catastrophe. It’s the same situation for exports, which have remained at 18.9% below the figure for 2008, the year prior to the crisis of 2009 which reduced trade flows the world over.

Secondly, the stagnation in exports has resulted in a trade deficit, unheard of in Japan’s recent history, reaching 4.8 trillion yen over the course of 12 months up to June (1.0% of GDP). The persistence of this deficit compromises the positive nature of the current account balance, whose cumulative surplus over 12 months went from 20.7 trillion yen in 2007 to 4.4 trillion in June 2012.

This represents a risk to the huge government debt, which is currently 230% of GDP, introducing the possibility of a need for external financing. Hence the latest fiscal savings measures which the government approved at the end of June, with a sales tax that, from the current rate of 5.0%, will go up to 8.0% in April 2014 and 10% in 2015.

The tax hike coincided with demand indicators that confirmed a slump in consumption and a return to lethargic domestic demand. While retail sales slowed down in June, prices have confirmed the continuation of the deflationary trend. June’s CPI fell by 0.1% year-on-year and core inflation, the general rate without foods or energy, dropped by 0.6%.

Be the first to comment on "An inopportune trade deficit for Japan"