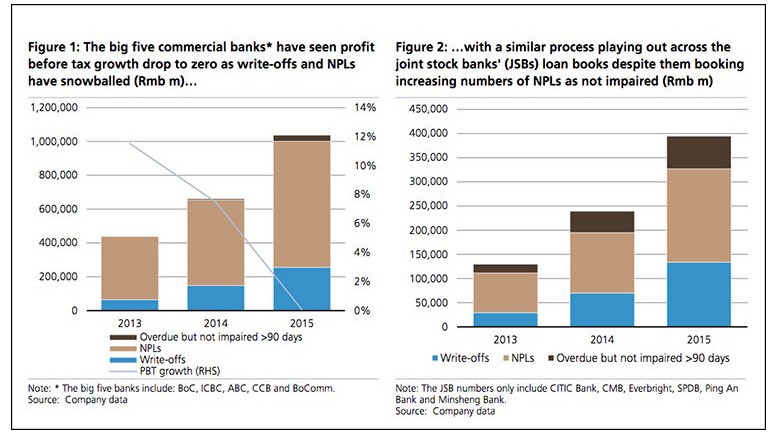

UBS | Regulators are establishing a foundation to allow banks to deal with NPLs Regardless of the success of local asset management companies’ (AMCs) individual initiatives, debt-to-equity swaps or NPL securitization, the authorities are showing a resolve to create concrete structural change to allow banks to solve their NPL issues. We think the severity of the credit cycle and the level of recapitalization ultimately needed will largely depend on whether banks can appropriately exit problem loans within a reasonable timeframe and at appropriate values. The credit cycle is worsening NPL formation, write-offs and loans being deemed overdue but not impaired have all risen sharply in 2015. And we are far from done, in our view. Many of the over- capacity industries we associate asset-quality problems with are still not significant NPL contributors. Most NPL formation stems from the private sector, and is still largely concentrated in more robust economies in the coastal and southern regions.

The expansion of the local AMCs is likely to bear fruit

We believe the rapid expansion of the local AMCs will ease the bottleneck created by the previous monopoly under the big four AMCs and have a material impact in some provinces. But, we expect the impact to be deeply uneven. Local AMCs in Shandong, Guangxi, Henan, Hebei, Shanxi, etc. appear structurally much better ali gned to resolving local NPL issues than peers in places such as Ningxia, Anhui, Inner Mongolia and Liaoning. We believe this is particularly positive for regional lenders where asset- quality issues are more acute and realising value on assets is harder und er the current framework.

NPL securitization could be a game changer

Details on the speed of the roll-out and the size of the new NPL securitization programme are still scarce. However, guidance provided by regulatory authorities on 19 April 2016 points to creation of an NPL securitization ecosystem that brings together banks, asset advisors, debt servicing firms, trust companies and rating agencies to package and distribute NPL asset-backed securities (ABS) to a bifurcated investor base. Under such a structure, we think the banks could internalize the NPL resolution process and create a wider market for the sale of these assets, while disrupting the dynamics of the current buyer’s market set by the big four AMCs and expanding the range of NPL assets banks could realize value on.