UBS | We hosted three meetings in HK this week for Chinese construction companies, which included China Railway Construction Corporation (CRCC), China Railway Group (CRG) and China Communications Construction Company (CCCC). Overall, management of the three construction companies were upbeat on the 2016 growth outlook, in terms of new contracts, revenue, and gross margins, etc. Management regards VAT reform and impairment loss as two major uncertainties.

Positive guidance provided for 2016

All three companies guided about 10% new contract growth in 2016, and some already noticed above 10% new contract growth in the first two months of 2016. Overseas and municipal works are expected to deliver stronger growth than other segments in 2016. 2016 revenue growth guidance ranges from high single digit to ~10% in 2016, underpinned by strong new contract growth momentum from H215. Management also believe that gross margin will remain stable if not improve in 2016, thanks to better project management and more high-margin overseas/municipal works.

Turning more positive on VAT reform impact; impairment remains uncertain

Management now expect impact from VAT reform (effective from 1 May) to be neutral to very minor positive/negative impact during the initial implementation stage, and they see positive impact in the mid-to-long term. This is to compare with their previous guidance (e.g. at our January conference) of negative impact during the first year of implementation due to difficulties of collecting VAT receipts. A significant rise of asset impairment loss in 2015 was one major focus by investors, although management also see this as one major uncertainty for 2016, in terms of further provision or write-back.

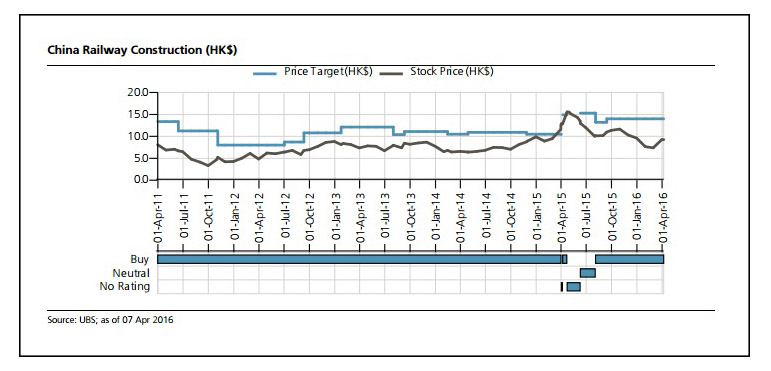

Stock picks – CRCC most preferred

Our most preferred stock is CRCC, benefitting from significant railway investment and rising subway investment in China, as well as fast expansion into the overseas market. Net gearing already improved to a comfortable level of 45% as at end-2015, thanks to record-high OpCF generated in 2015.