UBS | We reviewed the financial statements of 134 banks to understand loan exposure by industry as well as to try to estimate the size of private – sector lending versus state – sector lending. While we believe that manufacturing and wholesale and retail are where private – sector lending is concentrated, we believe the best way to quantify private – sector lending is by aggregating the micro – and small – sized enterprise (MSE) loan books and the consumer loan books. As a percentage of total loans this can rang e from 4.8% to 90% of total loans across different banks.

NPLs are concentrated in three key industries

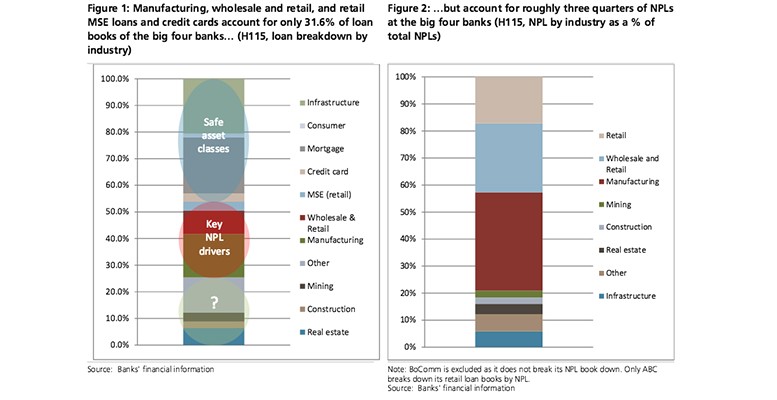

Manufacturing, wholesale and retail, and micro – enterprise loans in the retail books are the key NPL contributors with a nearly three – to – one gap in terms of their proportion as a percentage of non – performing loans (NPLs) compared with total loans. This aligns with our view that the banking sector is currently going through a private – sector credit cycle as we believe this is where private – sector lending is concentrated.

Worry not where NPLs are, but where they are not

We believe some of the well – documented stresses in the state sector and large private enterprises have yet to translate into NPLs due to the complications of impairing them as a result of cross – acceleration regulatory requirements and loan guarantee chains. We believe that in many cases these problematic parts of the loan book are being booked or rolled over in the shadow loan books or being categorized as overdue but not impaired so as to avoid impairment recognitions. Government intervention to prop up distressed local champions also plays a role, but we believe it is secondary to the above concerns.

The big five banks have the most robust balance sheets to weather the cycle

We think that strong retail loan books combined with much larger infrastructure loans will act as a significant buffer for the big five banks to weather a credit cycle that we believe began in H214. Joint – stock banks and the regional lenders, though, are far more exposed to the private sector and areas in which we believe further stresses are likely to be realized.