In an oped today, Taylor writes :

In the years leading up to the panic, mainly 2003-05, the Federal Reserve held interest rates excessively low compared with the monetary policy strategy of the 1980s and ’90s—a monetary strategy that had kept recessions mild. The Fed’s interest-rate policies exacerbated the housing boom and thus the ensuing bust. More generally, extremely low interest rates led individual and institutional investors to search for yield and to engage in excessive risk taking, as Geert Bekaert of Columbia University and his colleagues showed in a study published by the European Central Bank in July.

I fully agree with the “regulators at fault” argument, but not at all with “the Fed´s interest rate policy exacerbated the housing boom and ensuing bust” argument.

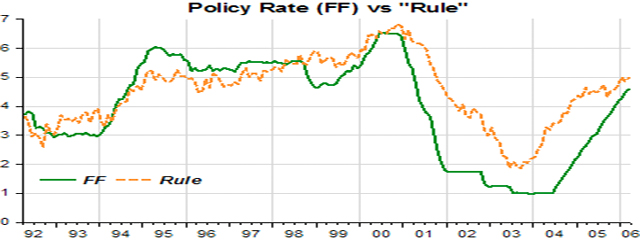

Taylor subscribes to the conventional view that monetary policy equals interest rate policy. Therefore, if the FF rate is below the rate indicated by the “rule”, monetary policy is deemed “easy” (loose, lax), and vice-versa if the policy rate is above the “rule” rate.

But if you interpret “easy” monetary policy as NGDP growing above trend (positive gap) and “tight” monetary policy as NGDP growing below trend (negative gap) you would say that monetary policy was “too tight” in 2001-03 when the gap turned significantly negative (despite the policy rate being less than the rule rate)and that monetary policy was “correct” in 2003-05 when NGDP was converging to the trend level (closing the gap), despite the rising policy rate during part of this period.

Read the whole article here.

Read all posts by Marcus Nunes here.

Be the first to comment on "FED: If John Taylor can repeat himself, why can´t I?"