In a paper released last week, the authors, including Director of Monetary Affairs at the Fed William English, concluded that in a scenario such as the current one in which the policy rate is already close to zero, inflation is below its current target and the economy is in excess supply, a “once-and-for-all increase in the target rate of inflation to three percent…could, if communicated clearly and found to be credible, improve economic outcomes.”

This view is not new. An increase in target inflation rates – to 4% to provide a greater cushion against negative shocks – was also proposed by the IMF’s chief economist Olivier Blanchard in 2010. In 1999, then Princeton Professor Ben Bernanke proposed in a speech on Japanese monetary policy that “a target in the 3-4% range for inflation, to be maintained for a number of years, would confirm not only that the BOJ is intent on moving safely away from a deflationary regime, but also that it intends to make up some of the ‘price-level gap’.”

Also referring to a “price-level gap” approach to inflation targeting, New York Fed President Dudley suggested in 2010 that the Fed could “keep track of inflation shortfalls when the Fed is constrained by the zero bound,” explaining that “if inflation were 0.5 percentage points below the Fed’s inflation objective, the Fed might aim to offset this miss by an additional 0.5 percentage point rise in the price level in future years.”

Given that there appears to be support in theory for the strategy of increasing the target inflation rate permanently, or at least temporarily, why has it not been put into practice? The concern seems to be in the assumption that the increase is taken as credible. English, et al, conclude that “a number of communications challenges make such changes in framework less likely to be successful in practice.” Similarly, Dudley cautioned that the price-level targeting approach “would only work well if people understood how it would operate and formed their expectations of future inflation accordingly.”

Along the same lines, in written testimony related to her confirmation hearing, Fed Vice Chair Yellen, in answering a question about Blanchard’s 4% inflation target proposal, stated that “a higher long-run inflation objective would give the Fed more manoeuvring room in the future,” but it could also lead to “erosion of the Fed’s hard-earned inflation credibility.”

She followed by saying that the “issue will be debated by economists in the years ahead, and I will follow such discussions with interest.” In other words, while the strategy of an explicitly higher inflation target might be something policymakers would support, the concept is difficult to communicate and risks un-anchoring the inflation credibility monetary authorities have built over the past 30 years. Thus, they are unlikely to make an explicit shift in the target.

While the Fed is unlikely to declare that it has an above-2% inflation objective, we think a weaker form of this – tolerance for modestly-higher-than-target inflation outcomes – is already in place. Last September, the FOMC statement began including the line that “the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens.”

This new reaction function indicates higher tolerance of the risk of inflation as a result of stimulative policies being left in place too long. In December, the Fed indicated that as long as the unemployment rate was above 6.5%, it would look past a rise in inflation as long as its 1y1y forecast did not rise above 2.5%. We argue that for that forecast to be above 2.5%, realized core PCE inflation would likely need to be consistently higher than that for several quarters.

The economic and fed funds projections from this September’s FOMC meeting are also consistent with greater inflation risk tolerance. The forecasts for the end of 2016 had inflation and the unemployment rate close to the long-run projections, but that for the funds rate still 2% below the appropriate long-run rate.

At the press conference that followed, Chairman Bernanke indicated that because of ongoing structural issues, this policy stance would be appropriate, but most economic models would indicate that inflation would subsequently rise. Similarly, when Yellen discussed the “optimal control policy” approach to monetary policy last June, she showed a projection that under optimal control, inflation would be consistently above 2% throughout the five-year projection period. The clear implication is that modestly higher inflation is the accepted trade-off for a more rapid decline in the unemployment rate.

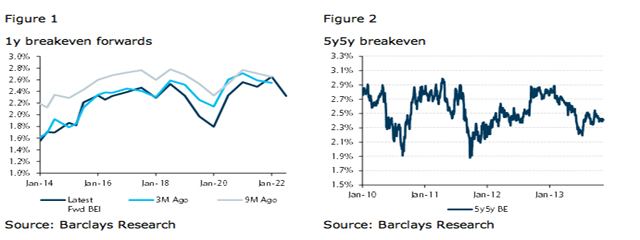

We believe that the TIPS market is underpriced for the Fed’s tolerance of higher inflation outturns over next few years. Even though recent realized inflation has been low, we believe that the inflation risk premium, as priced in the market, is near zero and that forward breakevens should be 20-30bp higher.

For example, accounting for the basis between PCE and CPI, 5y5y breakevens at about 2.4% are priced for the Fed to hit its target exactly over that period (Figure 2). While that may be fine as a baseline forecast, it does not account for the higher risk tolerance toward inflation discussed above. We have already recommended longs in 5y5y breakevens and believe that current levels remain attractive.

Sources:

http://www.imf.org/external/np/res/seminars/2013/arc/pdf/english.pdf

http://www.imf.org/external/pubs/ft/spn/2010/spn1003.pdf

http://www.princeton.edu/~pkrugman/bernanke_paralysis.pdf

http://www.newyorkfed.org/newsevents/speeches/2010/dud101001.html

http://www.federalreserve.gov/newsevents/speech/yellen20120606a.htm

Be the first to comment on "Higher inflation target: A communication issue"