Mexico boasts the world’s 11th largest population, rapidly growing and urbanizing in comparison with bigger (but more demographically mature countries) such as US, Russia, or Japan. Unsurprisingly, GDP per capita is close to emerging peer Brazil, but still 3-5x below western levels.

Mexico also appears widely underinvested from a power and gas infrastructure perspective. Gas appears a priority given the large usage in power generation. These fact shows how far behind Mexico is on a kilometres of electricity-networks per capita. Also, Mexico ranks poorly when it comes to relative percentage of (power) network losses.

Similarly, in terms of generation capacity, both on an absolute as well as relative to the number of inhabitants, Mexico looks significantly underinvested.

Additionally, energy consumption has been growing steadily: Since 2000, power demand in the country saw a 2.3% CAGR, i.e. a cumulative increase of about one tirad. Over the same timeframe, gas consumption grew at a 5.6% CAGR, leading total demand to more than double.

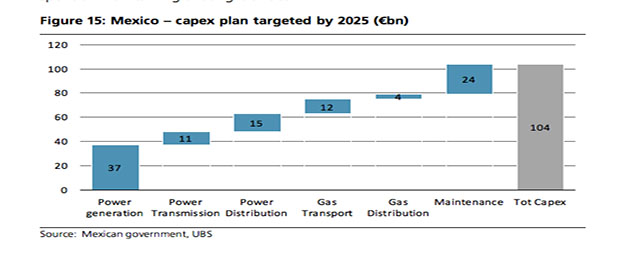

The new energy policy recently introduced – presented by the President Mr Pena Nieto, approved by the Council of Ministers, and currently going through the lower house where the government holds a majority – provides a major capex opportunity. By adding together the power and gas infrastructure projects targeted by the government, analysts calculate around €100bn investment opportunity. More than 1/3 of this is to be dedicated to converting older thermal plants into CCGTs and to develop green sources (mostly hydro and wind). Some 40% will be dedicated to develop power and gas networks, whilst the rest is expected to be spent on maintaining existing facilities.

Based on government targets, about 2/3 of the above mentioned capex needs will be open to foreign capital. Excluding maintenance investments, this is equivalent to a growth capex open to non-domestic players of almost €55bn. Interestingly, most of these utilities already have exposure to Mexico. Out of the c€65bn of capex potentially open to foreign companies, we estimate that about €50bn is pure expansion and could therefore be of interest to EU Utilities. Namely, estimates of €18bn of investments by EU Utilities. Most of the companies eyeing the region are from Southern Europe. This would allow for a potential EBITDA uplift of c€2.6bn and a net income increase of €1.1bn.

Iberdrola – the largest non-domestic power producer in the region – looks best placed when it comes to being awarded PPAs on CCGT conversions and renewable projects. Mexico could also provide a meaningful upside for Enagas and Gas Natural Fenosa, mostly in gas T& D. Other companies that may exploit such capex-opportunity include GDF Suez, Enel and, possibly, REE. On analysts’ estimates, over the coming 10 yrs Mexico could boost these companies’ average EPS by more than 10%.

Enel and Iberdrola remain sector top picks. Enel is expected to have a multiple-expansion, based on (1) simplification of the portfolio which would lead to a larger stake in growth activities such as Latam. (2) solid growth thanks to a step up in growth capex; (3) rising share of regulated profits (more than 70% by 2019 estimated). On Spanish company Iberdrola, (1) the share price undervalues the regulated portion of the business (around 80% of EBITDA), (2) low risk, mid-single digit growth in net income led by asset expansion, and (3) attractive 5% DY, which should be growing through to the end of the decade. price targets are based on a PE multiple analysis.

Be the first to comment on "Mexico: ten-year, €18bn investment opportunity for EU Utilities"