It was 1958, and a recession was on in the United States.

The stellar University of Chicago economist Milton Friedman was testifying before the Joint Economic Committee of the U.S. Congress. In those days, it didn’t get any bigger than that.

The U.S. Federal Reserve caused the 1958 recession, Friedman flatly told the assembled Senators and Representatives, and media. How? Too-tight money, he stated. “[T]he tight money policy of 1956 and 1957 which coexisted with rising prices but whose delayed effects are with us in the current recession,” Friedman asserted before the august panel.

Today, Friedman’s commentary would be non-PC heresy in many U.S. politico-economic circles. When was the last time a conservative bluntly blamed a recession on tight money?

Sadly for Americans, the Fed of 2008 would pull out the 50-year-old playbook and repeat the mistakes of the Fed of the 1950s. Rattled by minor increases in prices, the 2008 Fed stomped on the brakes, bringing on the Great Recession from which the nation has yet to fully recover.

Since 1958, we have seen at the Fed half a century of financial modeling, new monetary theories, enhanced computer wizardry, and a vast new army of hundreds of PhD economists–and yet all the Fed new firepower has accomplished, evidently, is to embalm organizational norms.

Indeed, central bankers today are arguably less flexible than their brethren of five decades back. Transcripts from 2008 Federal Open Market Committee meetings reveal board members with a near-monomaniacal obsession with inflation—the word “inflation” (or variants thereof, such as “inflationary”) was used 2,664 times in 2008 FOMC meetings; “unemployment” only 275 times. This when the U.S. economy was on the cusp of the worst contraction in postwar history.

Of course, Friedman knew all about the debilitating effects of central bankers and their predilection for tight money. His classic, oft-cited, iconic work on the monetary causes of the Great Depression—A Monetary History of the United States, 1867-1960—is the arch-stone of modern economics. Friedman unapologetically laid the Great Depression at the door of the U.S. Federal Reserve, which tightened when it should have heartily printed money.

Interestingly enough, what is thought of as the “American Right” was not always fixated on inflation. As recently as the 1980s, right-wingers bashed the Fed for being too tight—indeed, in 1984 President Ronald Reagan’s Treasury Secretary Don Regan, exasperated at then-Fed Chairman Paul Volcker’s tight money policies, even publicly proposed moving Fed operations into the U.S. Treasury. Right-wing columnists ripped Volcker as a feckless Trojan Horse for Jimmy Carter Democrats.

And Paul Volcker himself, the towering U.S. central banker (1979-87) who crushed inflation? Well, the unrevised record shows he declared victory when inflation sank to the 4 percent range—about three times the current level that puts inflation-hysterics into a constant sweat-drenched apoplexy.

Somewhere along the line the American Right, and much of the economics profession, became fixated on rates of inflation, not rates of real economic growth. This may result from the hundreds upon hundreds of PhD economists now employed by the Fed, and that institution’s influence on scholarly journals and employment prospects. There is an unreasoning zealotry about “fighting inflation” that serves as a premise for monetary policy, in many circles.

No more on the American Right have we a Milton Friedman, who would state flatly that a recession or even a depression was induced by tight money.

For many, the topic of macroeconomics and prosperity is becoming a smaller and smaller world.

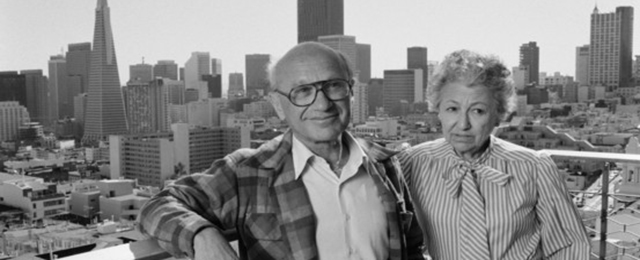

*Image: Milton and Rose Friedman/ Corbis via WSJ

Be the first to comment on "Monetary policy- the way we were (without revisionist history)"