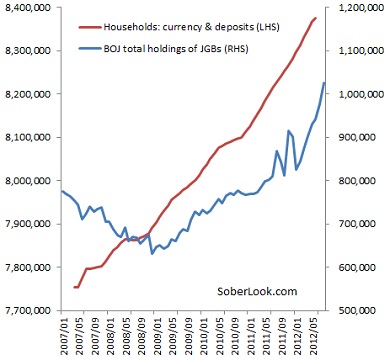

The Bank of Japan is struggling against deflation. The blue line in the chart represents the central bank’s purchasing of Japanese sovereign debt with money issued by the institution. The thing is that Japanese people pile notes and deposits of issued money at a speedier rate that the central bank releases it.

Economist Paul Krugman considers it an example of liquidity trap. No matter how much lower the interest rate falls, even if it drops to zero, people shows an elastic bottomless money demand paired with a strong tendency to accumulate. The result of this behaviour is deflation, as demand of goods and services suffers an inevitable contraction.

Deflation pushes real interest rates upwards so hoarding money turns profitable.

Monetarists reject that the zero lower bound problem is an actual threat. They’d say the central banks have some weaponry and that the key policy is an easy one: keep printing money until people feel their accumulated deposits are uselessly idle and start buying.

Keynesians, as Krugman, add that this situations needs some fiscal policy support: expanding the monetary base isn’t a bad move, it’s just that a public spending plan must be put in practice, too, to attract others’ demand to the markets again.

The trouble comes always, though, in the fact that those making decisions are politicians worried about their short-term needs and vote expectations. Besides, with a high debt level the margin for state spending is smaller. Right now, then, deflation is the enemy and should be the battle to fight.

Be the first to comment on "The Japanese liquidity trap"