DWS | Many post-war recessions have followed a well-known pattern. In any downturn, whatever its cause, private households and companies typically become thrifty. The overall economic savings rate rises. In typical economic models of aggregate demand and supply, the demand curve shifts to the left. This leads to a new equilibrium in which both economic output and price levels are lower than before. Depending on how flexibly wages and prices react, the slump can last for quite a while. According to many economists, only government stimulus programs will help output to swiftly return to its previous level.

Lately, there has been no shortage of fiscal and monetary support. However, the Covid-19 recession has also severely hurt the supply side of the economy. Many bans have been imposed to prevent the virus from spreading. Restaurants, hotels, gyms and other service providers were hit particularly hard by various lockdown measures. In the aggregate demand and supply model, this state-prescribed reduction in supply leads to both supply and demand shifting to the left. A Covid-19 recession equilibrium thus translates into significantly lower economic output. However, the decline in the aggregate price level would likely be quite modest.

Recently published inflation data seem to confirm this theoretical view. Without taking into account the energy component, which, thanks to the oil price, fluctuated wildly in 2020, the inflation rate in the Eurozone was 1.3% in June. That is exactly the same level as at the beginning of the year.

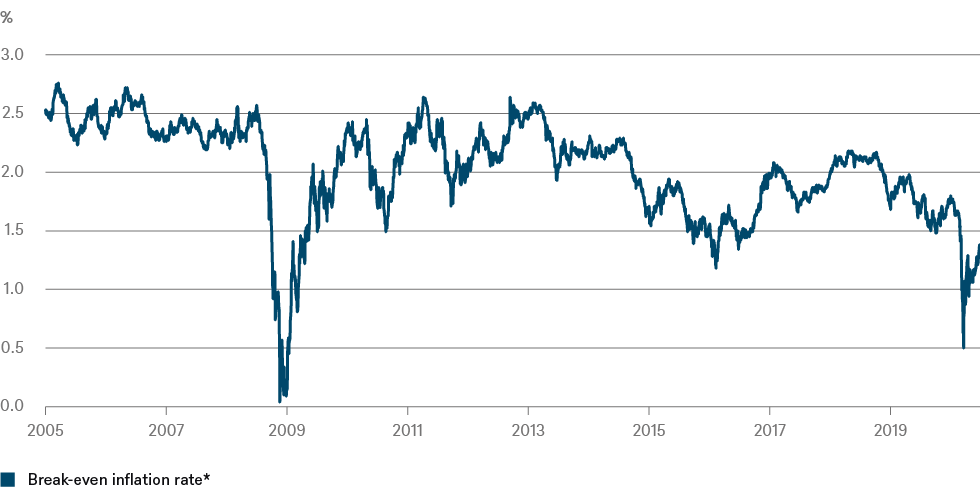

Which leaves the question how quickly the supply side is likely to recover? Certain restrictions will probably remain in place for many months, in order to avoid renewed waves of illness. That means the supply curve would remain stuck to the left of its old level, even as the demand curve shifts to the right again, as consumers and businesses start to spend more. The rising economic output would then be accompanied by a significantly higher price level. Fears of such a scenario may already be reflected in the bond market. As our Chart of the Week shows, the difference in yield from nominal to real U.S. government-bond yields suggests that inflation expectations have risen quite a bit since their lows in March. It is quite conceivable that unlike the economy, inflation could perhaps see a V-shaped recovery.