Between 2010 and 2012, the cyclical recovery in business confidence was interrupted by a series of public policy shocks. In 2010, the spike was driven by the passage of the PPACA and Dodd Frank and in 2011 by the debt ceiling debate and US sovereign downgrade.

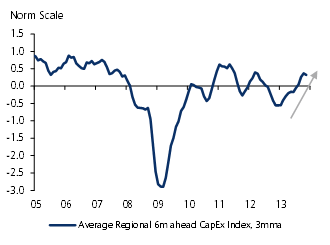

The culmination of policy uncertainty occurred during the 2012 election and the impending fiscal cliff, when capital spending fell into negative territory, a condition often associated with recession. To be sure, public policy risks persist, including PPACA and the off-balance-sheet entitlement obligations that we expect to cause a deterioration in fiscal metrics later this decade (2017). However, removing the risk of increased fiscal drag should boost business confidence and investment.

There is recent precedent for the US political system getting the fiscal accounts stabilized, despite an apparently tumultuous process. The 1994 elections turned the House Republican for the first time in 44 years and began a battle between House Speaker Newt Gingrich and President Bill Clinton that led to the last government shutdown before that of this past autumn.

Although the starting point for government spending relative to GDP was lower in 1995 than in this cycle, the drop was similar (4ppt) and not only did it lead to stable finances but bipartisan entitlement reform followed the budget battle.

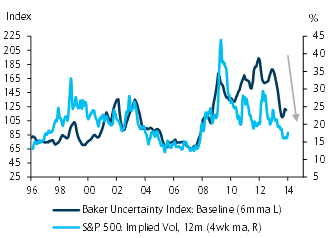

Figure 1

In our view, public policy uncertainty has contributed to weak business confidence and investment since 2010 (Source: Measuring economic policy uncertainty; Baker, Bloom, and Davis, 2013, Barclays Research).

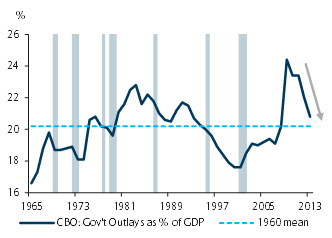

Figure 2

Since the 2010 mid-term elections, budget battles have led to an even sharper drop in outlays as a percentage of GDP. (Source: CBO, Barclays Research).

The current cycle has followed a similar trajectory: President Barack Obama was elected on a campaign platform similar to that of President Clinton (a larger state role in healthcare and higher taxes on upper-income earners) and two years into the Obama presidency the House turned to the GOP.

The ensuing battles led to the Budget Control Act of 2011, the first two-year outright decline in government spending since the end of the Korean War and a large tax hike in 2012. The cuts in spending and smaller-than-expected impact of tax hikes on consumer spending and overall growth resulted in an even sharper drop in outlays as a percentage of GDP and a FY2013 deficit that was $350bn narrower than expected.

As it turns out, the equity market reactions in each of the last two government shutdowns were nearly identical – and nearly undetectable when looking at longer-term charts (a 4% decline). In our view, the market’s sanguine reaction in both cases stemmed from the low associated risk of a deal that would result in significant fiscal drag, given that the economy was on solid footing and spending relative to GDP was already near the average since the late 1950s of 20%. We think the lack of an initial positive equity market reaction to Tuesday night’s budget deal is consistent with this; the markets had already looked well past this risk.

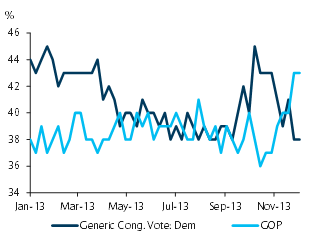

Looking to 2014, the debt ceiling issue remains unresolved; however, our model for the political reaction function is driven by polls. The GOP has ridden a rollercoaster in the Generic Congressional Polls, from -7 in the RealClearPolitics average early this year to even in August, then falling to back to -7 following the shutdown only to find itself+2.6 in the latest reading as a result of the difficulties with the ACA launch.

Thus, as demonstrated by the two-year budget deal, we doubt the GOP will have any interest in renewing the fight, especially given that mid-term elections in the second term of a two-term presidency tend to favor the minority party.

Thus, although the market did not have an initial positive reaction, we would not dismiss the positive effects on business confidence and investment of removing this impediment. We are not arguing that public policy uncertainty completely explains the weak capital and labor investment cycle. S&P 500 revenues came under significant pressure in 2012 from the recession in Europe and the impact of this on global trade.

However, with the European recovery, improvements in global trade, and increased consumer spending in the US as the effects of tax hikes fade, we believe the improvements in capital spending in 2013 from the trough in 2012 should accelerate in 2014. We are overweight the Industrials and Technology equity sectors because we believe they are best positioned to benefit from this trend.

Figure 3

With the GOP having ridden a rollercoaster in the Generic Congressional Polls, we doubt it will be interested in renewing the fight. (Source: Gallup, Barclays Research).

Figure 4

With the improvement in global growth and domestic consumption, capex should continue to accelerate in 2014. (Source: Barclays Research).

Be the first to comment on "U.S.: Stumbling Toward Fiscal Stability"