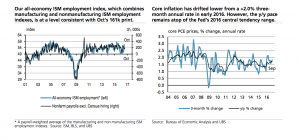

UBS | Our 165k forecast for headline payrolls and 155k forecast for private payrolls are marginally faster than the October increases but marginally slower than earlier in the year. Year-to -date, total payrolls have increased by 181k per month on average and private payrolls by 161k. We project a 0.1 pt decline in the unemployment rate to 4.8%. FOMC minutes suggested a Fed ready to move at the December meeting (as we expect), and we do not expect the November employment report to dissuade them.

The manufacturing ISM index probably rose 1.9pts to 53.0 in November —the high for the year—following generally healthy regional factory surveys.

Core inflation probably rose 0.1% m/m in October, leaving the y/y pace (1.8%) at the top of the Fed’s central tendency range.Rising energy prices most likely lifted headline PCE prices to a 0.3% m/m rise in October, bringing the y/y change to 1.4%, the fastest rate since November 2014.

We expect Q3 real GDP growth to be revised up 0.3 pct pt to a 3.2% q/q annual rate. Maybe more importantly, corporate profits are likely to show their first y/y rise since Q115.

The past week

Data released this past week were mostly positive: durable goods orders rose for a fourth consecutive month. Orders for and shipments of nondefense capital go ods excluding aircraft rose in October, suggesting business investment up at the start of Q4. The final University of Michigan consumer index improved in November, capturing post -election optimism as Americans digested President- elect Trump’s proposals. Housing market demand remained healthy, as existing home sales rose to a post-crisis high in October (5.60M unit annual rate). While new home sales fell 1.9% m/m to a 563k unit annual pace in October, they were still up a rapid 17.8% y/y.