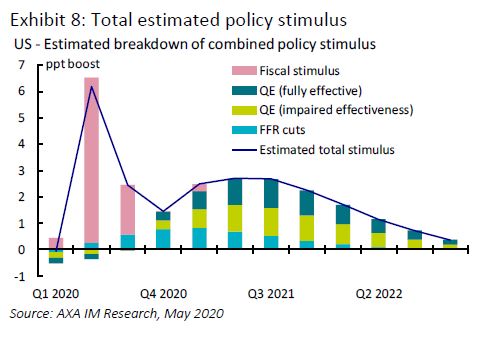

David Page (AXA IM) | We have described an unprecedented package of stimulus measures in the US from the federal government and the Federal Reserve. In our estimates, this combined package should provide a peak boost to the economy of around 6ppt in the short term, with Fed policy easing helping to provide an average stimulus of around 2.5ppt of GDP in 2020 and 2021, excluding the impact of further Fed lending programmes.

The crucial judgement is whether this has been enough. One measure of this should be our forecast that Q2 GDP is set to contract by 10%qoq. We suggest that this stimulus should limit GDP contraction this year to 3.8% and we forecast an above-consensus 5.3% rebound next year. Yet even on our relatively bullish assessment the US economy will close 2021 1.7% below the level of GDP it would have achieved with potential growth from end-2019. This suggests the US economy would still exhibit spare capacity – a higher level of unemployment than at the start of 2020 and lower capacity utilisation, something that is likely to leave the Federal Reserve struggling to achieve its 2% inflation target – let alone anything higher.

As such we see this as a likely justification for further policy stimulus in the near term. In recent days President Donald Trump, US Treasury Secretary Mnuchin and Fed Chair Powell have all separately suggested that more fiscal stimulus was likely over the coming weeks in the US.

We have argued that the emergency fiscal stimulus applied to date has been effective in supporting household incomes, providing cash to state and local governments for healthcare provision and providing some relief to small businesses. It will be important – but increasingly difficult – to ensure that future fiscal stimulus packages are as effective. Further fiscal stimulus may have to continue to support these same areas, particularly if a second wave of the virus materialises. However, focus should also shift towards efforts to stimulate future activity. Previous attempts to stimulate corporate investment through tax breaks have met with only limited success and other tools may have to be explored to boost corporate spending – perhaps including conditional corporate debt relief. Moreover, difficulties in boosting corporate spending may require direct government spending – possibly into productivity-enhancing infrastructure.