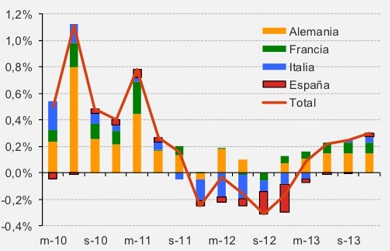

Analysts in Madrid follow closely their neighbour in travails, Italy. Yet, they cannot forget France or Germany, which as the ying and yang of the core euro zone need to agree on most of its future developments. A chart made its way to us today with all their GDP evolutions between 2010 and 2013.

The news aren’t exactly hopeful for the resident at the Moncloa, where the president of Spain officially lives. Afi experts said Wednesday in an investor note that there’s a higher probability that Italy reigns in its public deficit by the end of the year with a rate below 3 percent of GDP. “This would relax the necessary fiscal adjustment for Italy, and place it under a less exigent scenario than Spain’s,” they pointed out.

In 2013, according to market expectations, Italian GDP could fall less than 1 percent while the Spanish would reach a 2 percent drop.

What this means for the financial City of Madrid is that the recession in the periphery is likely to keep dragging down the GDP of the entire European Monetary Union area. In 2012, it could contract by 0.5 percent.

Economic perspectives will only turn positive for Italy and Spain by 2014. At least. Food for thought in Brussels, while negotiating further bailouts.

Be the first to comment on "Wednesday’s graph: wait until next summer for growth in Italy, Spain"