The current economic expansion now more than 10 years old, long by historical standards, as well as signs of overleverage in the corporate sector, combined with geopolitical uncertainty, suggest the next recession is not far off. According to a new study by Bain & Company, Beyond the Downturn: Recession Strategies to Take the Lead, companies that were well prepared emerged victorious from previous crises. These companies managed to survive, controlling costs and at the same time reinvesting in growth.

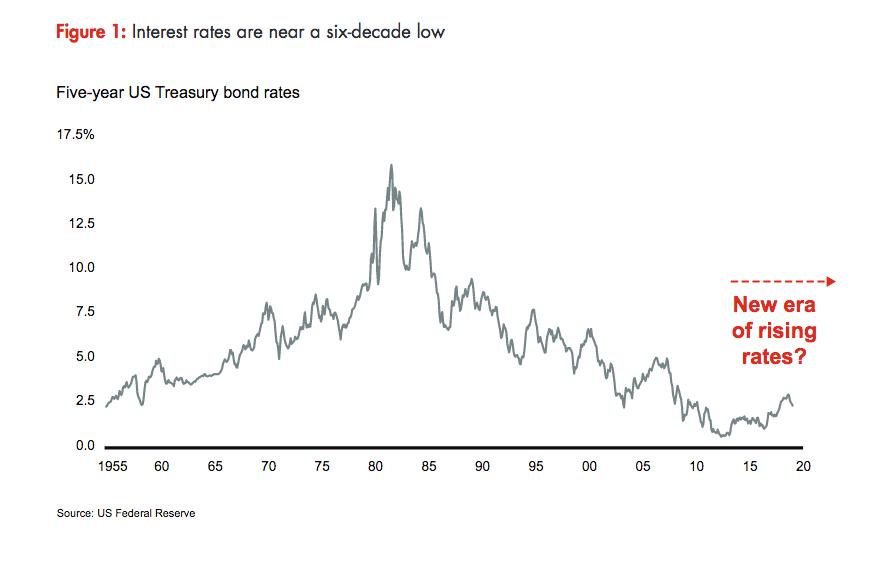

A recession will likely land soon, and structural trends will influence a new cycle, notably the accelerating technology revolution in many industries and the end of decades of low interest rates.

Headed into the global financial crisis a decade ago, a group of almost 3,900 companies worldwide that we ran through Bain’s Sustained Value Creators analysis posted double- digit earnings growth, on average, from 2003 to 2007. As soon as the storm hit, performance diverged sharply: The winners grew at a 17% compound annual growth rate (CAGR) during the downturn, compared with 0% among the losers. What’s more, the winners locked in gains to grow at an average 13% CAGR in the years after the downturn, while the losers stalled at 1% (see Figure 1).

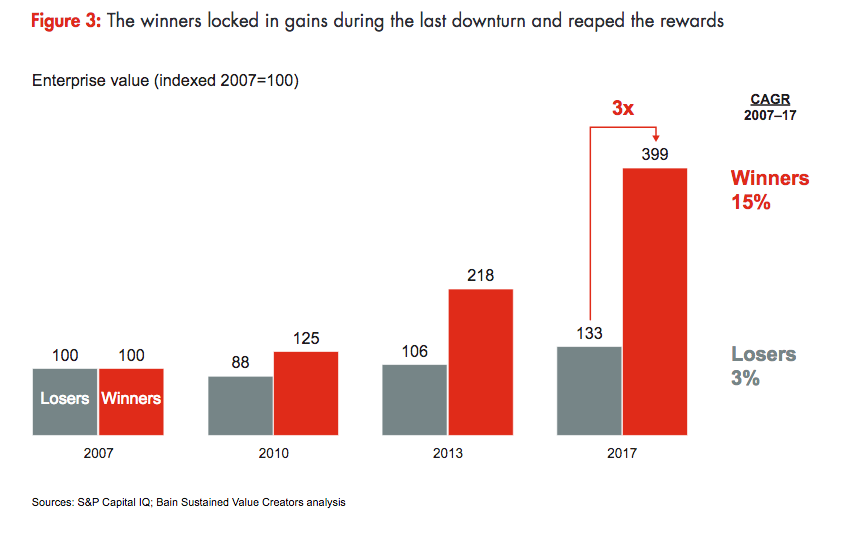

Downturns rearrange the board. The number of US companies that substantially increased profits was 47% higher during the last downturn than during stable periods. And 89% more US companies lostprofitability in the last downturn vs. stable periods. No question, recessions can swing the future mar-ket capitalization of a company by billions of dollars. For two US companies with a similar enterprise value in 2007, for example, our Sustained Value Creators analysis finds that the winners’ average enterprise value grew three times that of the losers by 2017 (see Figure 2). That difference is worth $6 billion in additional enterprise value, based on the median for the companies in our database.

The losing companies tended to follow a few recession dead ends. Some tried to slash and burn their way to the other side, under the misconception that extreme cost-cutting would be enough to survive the storm. They cut R&D across the board, scaled back on sales and marketing activities, laid off valu-able talent and ruled out acquisitions. Other lagging companies strayed outside their core business, investing in the latest hot sectors and tools, praying for a winner. Still others tolerated poor results during the downturn, waiting to see what would happen, and then finally took action—too late be-cause they bought the wrong asset or fell behind in product innovation

The winners excelled in four areas: early cost restructuring, financial discipline, aggressive commercial plays and proactive M&A.

Companies that ranked among the eventual winners, by contrast, moved deliberately to capture opportunities before the recession. While they focused intensively on cost transformation, they also looked beyond cost. Think of a recession as a sharp curve on an auto racetrack—the best place to pass competitors, but requiring more skill than straightaways. The best drivers apply the brakes just ahead of the curve (they take out excess costs), turn hard toward the apex of the curve (identify the short list of projects that will form the next business model), and accelerate hard out of the curve (spend and hire before markets have rebounded). What specifically distinguishes eventual winners? Bain research reveals several key moves by companies that outperformed peers, in four areas: early cost restructuring, plus some combination of balance sheet discipline, aggressive commercial growth plays and proactive M&A. It’s instructive to review each in more detail.

A four-point recession-readiness plan based on a company’s strategic and financial strength can help leadership teams prepare now. These range from investing for leadership based on a superior strategic and financial position, to readying a weak company for sale.

1. Start with the end in mind. What do you want the company to look like at the end of the down-turn and three years after? A future-back approach that defines the desired end state helps you know exactly where to invest—the customer segments to target, the value proposition and the digital technologies supporting the business. A clear plan lays out specifically how the business will outperform competitors through and beyond the downturn.

2. Stress test the P&L and balance sheet. Model the 2019–2022 P&L, cash flow and balance sheet through turbulent scenarios, including negative market growth, lower prices and higher unit eco-nomics, for your company and against your competitors.

3. Identify M&A targets early. Map out a proactive M&A plan that includes add-on acquisitions, di-vesting noncore assets, and potentially big moves with large-scale peers. That way, you can pull the trigger when the time is right, as opposed to reacting—and missing the opportunity.

4. Manage costs, now. A smart cost program starts early and focuses on sustained changes, instead of cutting muscle or trimming across the board. The magnitude and shape of a cost transformation will vary depending on your starting position, but the approach should keep out costs while you put the pedal to the metal coming out of the curve.