UBS | The recent credit market sell-off, spate of defaults, spike in Chinese yields and spreads, bond issuance cancellations basically reflect: 1) investors re-pricing credit risk and policy easing expectations; 2) increased supply of rates products like local government bonds; 3) issuers’ adapting issuance plans to a higher yield environment; and 4) rising investor redemptions and tighter restrictions on asset management accounts among others.

How big is the problem?

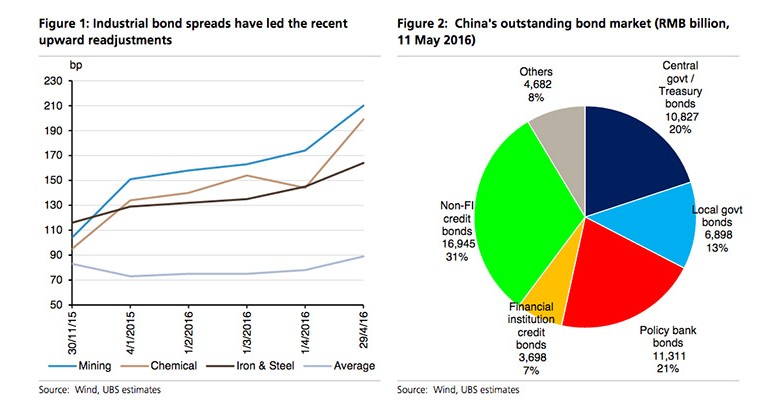

Of China’s RMB 54 trillion ($8.4 trillion) onshore credit/rates debt instruments, RMB 3.6 trillion is due to mature this year. Most are various short-term commercial papers (< 1 year maturity, no guarantee), and 15-20% relate to coal, nonferrous metals, chemicals, steel and other excess capacity-burdened industries where most defaults are concentrated.

How high is leverage?

Compared to last year’s equity market bubble when leverage peaked at over 4x, leverage in China’s credit markets is not as high: at 1.1 times in the interbank market and 1.2 times in the exchange market as of end-March (latest available). Such leverage has started to be unwound. Should it continue it may aggravate ongoing upward yield pressures, further reducing new bond issuances or increasing corporate financing costs. To set this in context however, while corporate bonds have been an important source of new credit in the past 6 months (providing <20% of monthly new credit), they have not been a key or irreplaceable source of credit for the economy.

How might the government or central bank intervene?

The government has a variety of ways in which to manage the situation, and has started to already. In April, almost RMB 440 billion of net liquidity was provided via open market operations and liquidity provisioning tools; notwithstanding the reduced need to offset in net capital outflows. Clarifications have also been made to upcoming tax rule changes that risked tightening corporate financing conditions; SOE risk and control measures stepped up; negotiations made to ensure that LGFV bond payment obligations are met; and last weekend allowing onshore asset management products (including WMPs offered by banks) to open accounts in the interbank bond market.

Will pressures on China’s credit market persist or could they return?

Credit market risk will likely persist to varying degrees throughout this year as more credit events emerge on weak underlying demand and slow excess capacity resolution. A liquidity squeeze or temporary credit crunch is not our base-case scenario, but the risk of one being triggered remains. Even once credit market issuers and investors have adjusted to a higher yield pricing environment, credit spreads for industrial issuers will likely continue to rise as investors become more discerning in their risk pricing. A smaller primary credit issuance market means that weaker issuers now face higher cash flow risk and financing costs going forwards, something that may pressure secondary market yields too. Until more serious debt restructuring takes place, the risk of one or a cluster of default events triggering another credit market selloff remain, even if that is not our base-case.