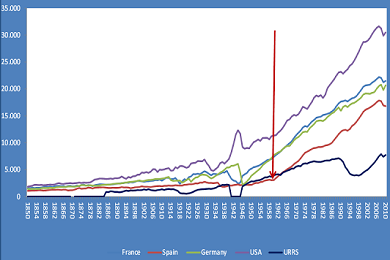

There are a few compelling lessons in this chart showing per capita incomes of a bunch of European countries together with the US’ and the former members of the URRS’ during the last 160 years.

Spain always was the laggard of the group. It only began to catch up with the rest of the economies in 1959, when the official Stabilisation plan pushed companies to sell and compete internationally while the currency–the peseta–was being depreciated. But internal demand was also boosted: from 1960 to 1977, Spain trebled its per capita income–it was $3,000 and went up to $8,883 in 1977, in 1990s dollars.

Up to the year when the housing bubble burst, Spain rapidly gained positions and was approaching economically stronger European countries. And the US ran above the others.

There are at least two conclusions we can get from these data. First, contrary to what some narrow-minded voices would say, wars cannot bring about prosperity, as it is clear in the graphic that World War II caused a huge contraction with Germany and France seeing their per capita income figures drop to Spanish levels, so to speak. Second, the former URRS economies are unable to benefit from their extraordinary natural resources and wealth creation ebbs away at every chance: capitalism proves to be the only social system that works.

But one more lesson would be the fact that state intervention plays an important role in economic growth. Post-war capitalism, in which the state had a leading hand addressing needs and generating markets, had extraordinary good results. As Larry Neal said, nineteenth-century capitalism just managed to crawl onwards. Capitalism needs a solid state to ensure markets perform correctly.

Be the first to comment on "Where free markets meet big state"