Yesterday the European Commission published its evaluation of the progress made by different countries towards their economic and social priorities. The report’s main conclusions on the Spanish economy

highlights that it is growing at a good pace and is gradually correcting its weaknesses. But there continue to be huge imbalances. The most important weak points are still unemployment and the high levels of both public and private debt.

The document mentions

that one of our biggest vulnerabilities is public debt, which is still not under control. Public debt as a percentage of GDP is not going to start to decrease, despite the strong recovery, due to the high public deficits, even though these are increasingly on the decline. Senior analyst Francisco López says the Bank of Spain recently revealed the figure for the public administrations’ combined debt for 2016.

This has risen by 32.438 billion euros (3% up on 2015) to 1.105 trillion euros.In terms of GDP, however, the debt ratio fell 8 tenths of a percent from 99.77% in 2015 to 98.98% in 2016, thanks to the economy’s strong growth and the favourable interest rate environment (the average rate has fallen from 3.1% to 2.8% approximately).

“In spite of the hefty increase in debt, which is at record highs, this ratio complies with the objective established in the 2017 Draft Budget sent to Brussels in December (99.4%),” López says.

These figures show that Spanish public debt seems to have stabilised below (although not by much) the limit of 100% of GDP. And this has happened against a backdrop of strong growth and low interest rates, but with fiscal adjustments still pending.

The Spanish economy has not done all its homework with regard to cutting public debt, but there are other imbalances which are being corrected. One example is the external sector thanks to the surpluses registered since 2013.

Brussels is also worried about the labour market. In spite of the significant reduction over the last three years, unemployment is still high,” the report says and calls for more measures in every area. “New political action would help to maintain the external surplus, guarantee a lasting correction in the deficit and support sustainable growth.”

And what does the report say about the Spanish banks?

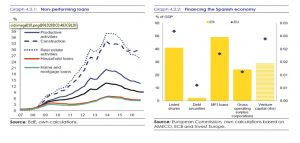

In the Commission’s opinion, the biggest problem is the restructuring of NPLs. On this point, the Spanish Banking Association (AEB) believes:

“It would be better if this could happen quicker. But we are talking about a provision already made of 15% of total lending. And a 14% annual decline in the bad loans’ figure.”

Even so, the most relevant is what we can see in the graphic.

And here we are talking about the importance of the Spanish financial sector for the economy, above the European average.

“Financing growth and innovation…Are there still some pending issues? Of course there are. But what is true is that the financial sector has advanced a lot in terms of adjustments and correcting imbalances existing in Spain before the crisis. This is preparing it to finance growth,” AEB concludes.