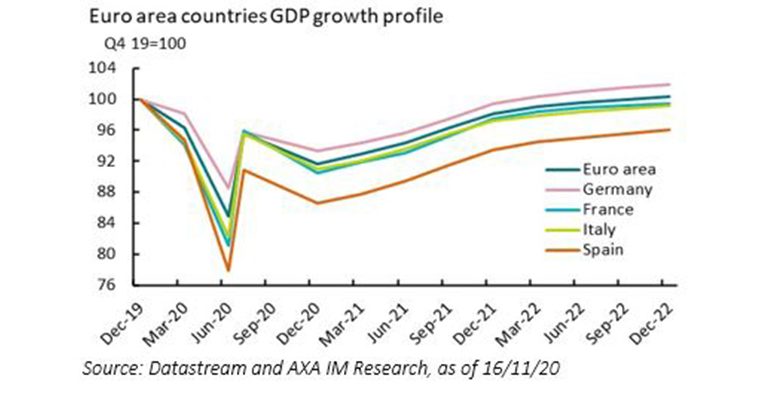

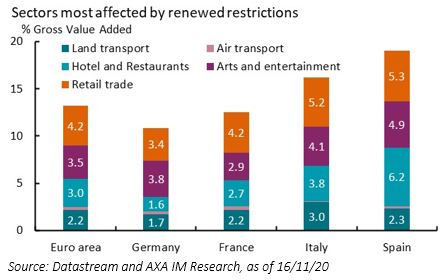

Apolline Menut (AXA IM) | For Eurozone economies, 2020 cannot end soon enough. After a 15.1% decline in the first half of the year and a strong, but partial, rebound in the Q3, the euro area economy is set to contract again in Q4 (-4.1%qoq). The autumn lockdowns triggered by the pandemic’s second wave are less restrictive than in the spring (schools, the public sector and industry remain open this time), and so is our assumption of activity hit (-10% in November on average for the euro area versus around -25% in April). But the euro area will finish the year 8.3 percentage points (ppt) below end-2019 levels and with large dispersion across countries. Virus developments, stringency of restrictions, exposures to the most affected sectors (Exhibit 1) and fiscal supports vary across countries. For that reason, we see German growth shrinking by “only” 6%yoy in 2020, half of the contraction we expect in Spain, and much better than the 7.7% decline we project for the euro area as a whole.

A vaccine will boost growth in the second half

We expect a shallow recovery in the first half of 2021. The news of a vaccine from Pfizer and Moderna is positive, helping dispel concerns that the lockdown/re-opening pattern and its persistent damage to trend growth would be permanent. Yet its near-term growth impact should be limited in our view – production and distribution capacity constraints suggest herd immunity may not be reached before the summer. In the meantime, we think governments will keep in mind a key lesson of the summer experience: in an imperfect testing/tracing environment, restrictions must be lifted gradually.

Despite a potentially positive confidence boost from the vaccine, countries have entered their second wave on a weak footing, having managed only partial repair from the first. Eurozone consumer confidence had plateaued over the summer and edged down in October even before stringent restrictions were announced. Although the labour market impact has been largely cushioned by short-time working schemes, the number of unemployed has increased by 15% since February and there are multiple signals of a job-poor recovery: employment fell by 2%yoy in Q3 and firms hiring intentions are down in both the services and industry sectors. In this context, precautionary savings should remain elevated in the months ahead, capping household spending.

The flipside is that corporates will continue to see demand as a key factor limiting production. Once again, this comes while activity levels have not fully recovered from the first wave. Even in the less affected industry sector, the capacity utilisation rate is still 6% below its pre-crisis level – it has barely improved from a record low in the services sector. Despite the help from short-time working schemes, profits have been squeezed, credit risks are piling up – banks have tightened credit standards on corporate loans already and expect further tightening in Q4 – and debt has risen sharply. This is not conducive to stronger investment, even without mentioning the risks of rising bankruptcies. So far, these have been suppressed by temporary regulatory forbearances, but demand may not pick up quickly enough to avoid them.

The broad deployment of a vaccine should allow for a full unwinding of containment measures, leading to some growth acceleration in the second half of 2021. A supportive external environment will add to a significant bounce-back of the domestic hospitality sector. Household consumption (precautionary savings to be unleashed) and exports (rising tourism) should fuel the recovery, but an investment rebound is likely to be capped by the debt legacy. In Q4 2021, we see euro area private consumption just 3.2% below its pre-COVID-19 level, but investment still 8.1% lower. Overall, the Eurozone should round off the year with 3.7% annual growth, followed by another solid 4.4% in 2022. Still, the economy would only be back to its pre-pandemic level at the end of our forecast horizon (Exhibit 2).

Read More…