Yesterday, Eurostat published the Consumer Price Index (CPI) for June, which rose 0.3% year-on-year. This is a rebound in inflation in the region from the 0.1% rate recorded in May. The figures were in line with analysts’ expectations.

Year-on-year, food, alcohol and tobacco prices rose 3.1% (3.4% in May), while services’ prices rose 1.2% (1.3% in May). Non-energy prices rose by 0.2% (the same as in May) and energy prices fell by 9.4%, significantly lower than the 11.9% drop in May.

Excluding food, alcohol and tobacco and energy prices, underlying CPI rose by 0.8% in June, in line with analysts’ expectations and slightly below the 0.9% increase in May.

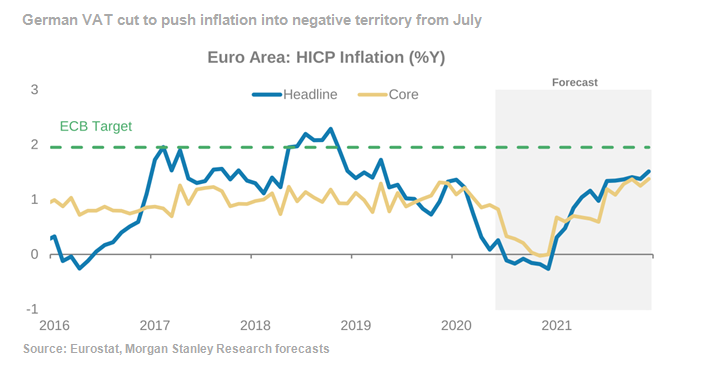

However, according to Morgan Stanley, this increase in the overall inflation figure is only temporary: “even with the effect of the German VAT cut, European inflation should become negative again in July,” they explain.

For the ECB, the inflation outlook is weak. This determines the political support the ECB can provide here. Bank buybacks and cheap financing appear to be the tools the ECB likes best, rather than rate cuts. And with the prospect that the Bundesbank will not have to withdraw from the PSPP programme, it appears it will have fewer constraints. The ECB will continue with this strategy until March 2021, when it will extend the PEPP until the end of that year.