Dirk Becker (Allianz GI) | Credit Suisse has been seen as the weakest link in the global banking sector for several months, after various scandals and poor management decisions. We think the merger can therefore help to stabilise the global financial system:

In our view, UBS are being paid for running down the risky parts of Credit Suisse, and they get to keep the highly profitable Swiss domestic unit in return. They will have a CHF 54 billion gain on the first consolidation because they are buying the Credit Suisse equity at a huge discount, and they get the AT1 capital on top for “free” – although there will likely be many issues to deal with over the coming years as the Credit Suisse positions are wound down and legal costs have to be paid. The decision of the Swiss regulator to wipe out Credit Suisse’s AT1 bonds while equity holders receive at least a token compensation initially sent shockwaves through the AT1 market (see above). If, in contrast to what had been said before, those instruments rank junior to equity in the capital stack, a repricing of those bonds would be required. Banks that issue new instruments will pay a higher risk premium, so this instrument becomes more expensive. (And if it becomes more expensive than equity, there is no reason to issue it any longer.) But in our view, the statement from EU regulators should calm fears in the European banks’ AT1 market.

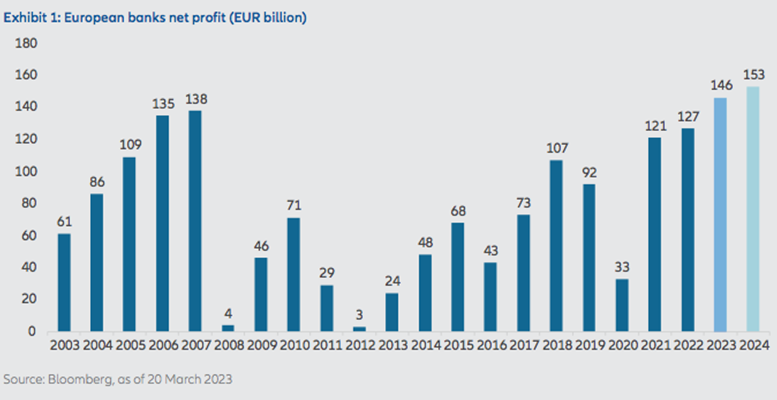

The takeover of Credit Suisse could be seen as a positive for the wider banking sector and the financial system as a whole. Banks are still expecting a record year in 2023 due to higher interest rates after posting their highest net profit last year since 2007 (see chart below). Q1 results should be helped by fixed-income trading. The economy is still stronger than anticipated, which should keep loan losses under control. The sector is trading on 0.6x price-to-book-value ratio and 6x price-to-earnings ratio for 2023E.

Looking ahead, regulation is potentially the key risk. Regulators tend to take a conservative view on risk and prefer to err on the side of caution. Will the European Central Bank (ECB) prefer the banks to keep equity on the balance sheet – rather than honour their commitments to generous dividends and share buybacks? While it is difficult to call, the Credit Suisse incident may be atypical of a sector that has – so far – seemed relatively robust during this crisis.