Regina Borromeo (Robeco ) | The 2020 US Elections have entered the final straight. While both the betting odds and the polls show former Vice President Biden leading decisively against President Trump, there is still a chance of an October surprise.

Even with 48 hours to go, key events occurred in the 1968 (Vietnam ‘Halloween Peace’) and 1980 (the final debate) presidential races. The past month has already seen the death of one Supreme Court justice and the nomination of a replacement; a rancorous debate, POTUS being hospitalized with Covid-19, and now speculation regarding Biden’s son Hunter’s involvement in various overseas business deals with potential conflicts of interest.

While derivative markets have been pricing in somewhat higher volatility around 3 November, until recently equities and credit spreads have not factored in any meaningful potential risks. We think the US presidential election – and, perhaps more importantly for the US Treasury market and dollar, the Senate elections – are just one of a cluster of highly volatile events, as discussed in our recent Global Macro Quarterly Outlook.

Betting odds and polling swing in favor of Biden

Since the summer, our view has been that voting momentum will follow the path of the pandemic and the economic recovery. Trump’s handling of the coronavirus pandemic has been compared to George W. Bush’s mishandling of the disaster response to Hurricane Katrina, which coincided with a fall in the then President’s polling and approval ratings. Biden currently has a strong lead in betting odds and national polls and seems to be ahead in key battleground states such as Pennsylvania, Wisconsin and Michigan, following the first chaotic presidential debate and Trump’s subsequent hospitalization with Covid-19.

National polls have seen Biden extend his lead to over 10% recently, a larger spread compared to 2016 when Hilary Clinton ran against Trump. Remember, because of the US’s electoral college system, a 3% national poll lead for Biden could fail to be translated to state (electoral) level, as occurred in 2016.

Biden’s recent surge has led markets to price in a base-case probability of Democrats gaining control over both houses of Congress, the Senate and House of Representatives, in a so-called ‘Blue Wave’ scenario. With the vote for the House expected to remain more than 90% probability for the Democrats, the vote for the Senate is key. To gain control, the Democrats need to flip three Senate seats if Biden wins (or four if he loses). PredictIT and FiveThirtyEight models give a 66% chance for a Democratic Senate with trend direction similar to the presidential elections.

Thrust of Biden’s policy and potential Democratic blue wave

Biden’s election platform is more progressive and liberal than what investors would have historically expected from a moderate candidate. His proposed spending plan of over USD 6 trillion for the next 10 years includes infrastructure (USD 1.3 trillion), climate change (USD 1.7 trillion), healthcare (USD 750 million) and higher education (USD 1.5 trillion). The plan suggests these elements will be mostly financed by increases in income tax, capital gains taxes and corporates (28% tax rate) as well as closing tax loopholes. However, legislating these changes could be difficult in practice. Even if the Democrats win both the presidency and the Senate, any legislation would need to gain approval from the moderate Democrats in Congress as well. In addition, some of the proposed measures will require a supermajority of at least 60 seats in the Senate, or face a difficult approval process.

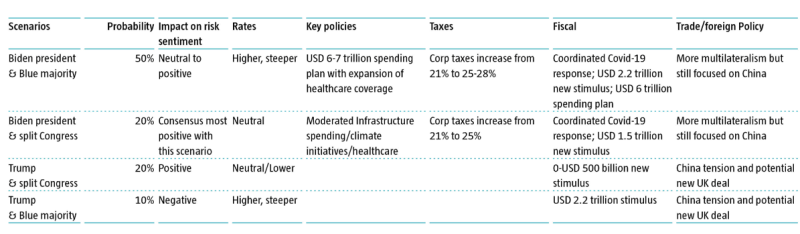

The recent positive response to the probability of a Blue Wave increasing suggests the market has endorsed the view that a large stimulus plan, along with less foreign policy uncertainty, should offset the negative effects of higher taxes and more financial regulation. This is a change compared to several months ago, when the Blue Wave scenario was viewed by the consensus with risk-off concern over higher taxes. We see four main scenarios regarding election results, depicted in the table.

Implications for Fed policy and interest rates

Whether an additional fiscal stimulus deal is agreed ahead of the elections is a key current driver of rates markets. A deal is much needed, as was underlined in the minutes of the September FOMC meeting. A pre-election deal would lead to higher Treasury yields and a steeper curve. If no deal is reached before the elections, we still expect one but only after a clear election result. In that scenario, uncertainty will prevail in the near term on both the fiscal and electoral fronts. We give a probability of 70% to no fiscal deal before the elections.

A contested election is the main risk to fiscal stimulus in the short term. There is only one scenario (Trump, split Congress) where we don’t expect a meaningful stimulus deal in the longer term either.

2000 as guide

As Biden has expanded his poll lead, the risk of contested election and/or delayed results with legal challenges and unrest has become underappreciated in markets. This scenario would certainly be a risk-off event in the short term with increased volatility.

Despite Biden’s lead in the polls, Trump’s approval rating has remained relatively steady, with a solid underlying level of support in the 35%+ zone. At over 40%, the incumbent president still has a good chance of winning. To win, however, pollsters suggest that demographically speaking, Trump needs to win support from educated women – hence his focus on the suburban family vote. For the next two weeks, especially if no clear winner emerges on 3 or 4 November, we expect risk sentiment to be vulnerable and volatility to rise in the short term.

History will tell if the coronavirus is to Trump what Hurricane Katrina was to George W. Bush’s legacy.