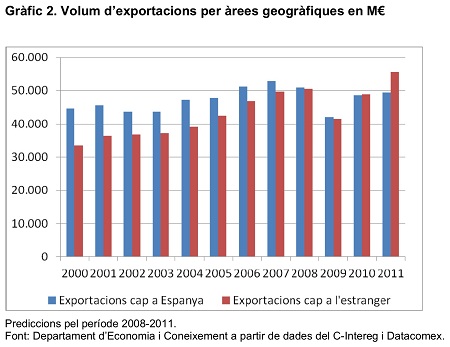

The implications of recent developments in Catalonia's export activity are bound to agitate the political scene of the region more than its economic stand, which remains at a deficit of around €15 billion. According to the statistics institute of the autonomous government, the Generalitat, Catalan exports to non-Spanish markets in 2011 were higher for the first time than those to Spain: the regional department for the Economy said the international trade percentage of the total exports was 52.9, whereas it was 47.1 to other regions in Spain.

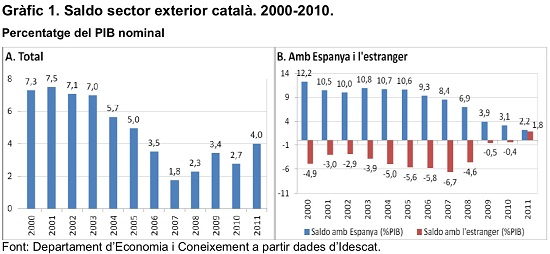

Overall, the 4 percent-per-GDP exports last year approached 2005 levels, which could be read as a hopeful sign that Catalonia is already in recovery phase. Exports have consistently grown since the beginning of the global crisis in 2007, when at 1.8 percent-per-GDP recorded its lowest since 2000.

This is good news, although Catalan president Artur Mas will still struggle to meet the deficit target of 1.5 percent. The Spanish government has recognised an annual fiscal deficit between 6% and 9% of Catalonia's GDP (depending on the calculation formula), that is, Catalonia would be supporting a transfer of roughly the same amount as its total deficit each year to the rest of Spain. A seemingly lesser dependence of the

Catalan industry on Spanish demand will inject oxygen to nationalists, who from outside and particularly inside Mas' party, Convergencia i Unio, have accentuated their claims in favour of a Catalan State.

But those seeking separation from Spain should look for further arguments. The economic link between Catalonia and Spain is as strong as ever. To the depressed Spanish internal import needs, Catalonia's economy has responded with a contraction of 0.1 percent in the first quarter of this year, as happened in the last quarter of 2011 when the region's GDP fell by 0.5 percent.

Compared to the rest of industrialised countries, Catalonia improved its industry's competitiveness index by 0.7% year-on-year just between October and December in 2011. The change is not unlike what the Spanish sector has experienced, and would not grant Catalonia access to the financial markets as an independent sovereign issuer. The region, which represents one fifth of the Spanish economy, has more than €13 billion in debt to refinance in 2012, apart from its deficit.

And the surplus per GDP with Spain continues being higher than with international markets.