Spain is expected to be one of the best performing markets in Europe over the next five years. Led by last year’s yield compression, the upturn is set to be sustained by a rebound in prime rent, which importantly has now started to materialise in Madrid and Barcelona, Deutsche AWM analysts commented.

“Given the rental outlook and the weight of capital targeting Spain, securing the most prime real estate could prove difficult. With this, we see value in selectively taking on leasing and (re)development risk in the heart of Madrid and Barcelona – where high quality stock is in short supply – while also considering prime, centrally located opportunities in second tier cities such as Valencia and Bilbao,” they noted in their Europe Real Estate Strategic Outlook: Mid-Year Review

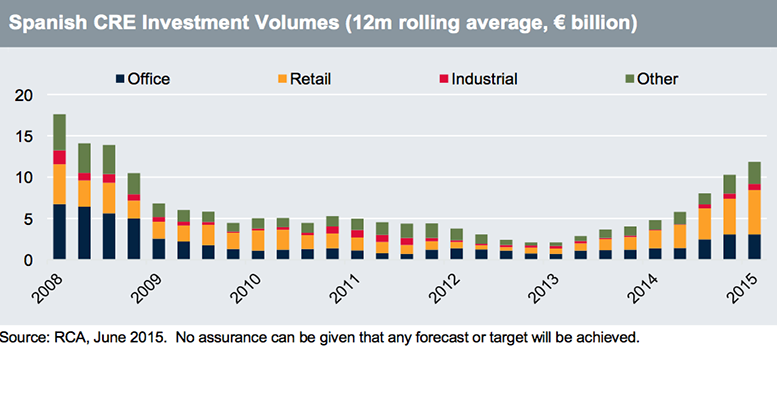

Investment wise, they highlight the weight of capital targeting Spain. Investment volumes are moving towards pre-recession levels and yields continue to fall and are now close to historical lows. Positive yield impact to have run its course mostly by end-2016.

“Capital is moving beyond Madrid and Barcelona. Second tier cities are currently offering a yield premium of around 200 basis points. Within core locations, value-add opportunities supported by lower va- cancy, rising demand and a long period of low new supply.”