The process of fiscal consolidation appears to be a long-distance race. After 2 years of huge effort, the race goes on in 2013. We already know where the finish line is, namely achieving a deficit of 4.5% of gross domestic product (GDP), but the starting line is still unknown. In any case, it looks like financial tensions, which are gradually tending to improve, might make the race easier to run this year.

According to the European Commission’s Stability and Growth Pact (SGP), Spain’s deficit must be adjusted by 1.8 percentage points of GDP this year (2.8 percentage points if we include the 2012 losses from the Fund for Orderly Bank Restructuring or FROB). The greatest fiscal effort falls to the autonomous communities, whose deficit must reach 0.7% of GDP, 0.8 percentage points lower than last year’s target. The adjustment required from central administrations, which include central government and Social Security, is 0.7 percentage points, to reach a deficit of 3.8% of GDP. For their part, local government corporations must end the year with a balanced budget compared with the deficit target of 0.3% of GDP in 2012.

However, any deviation from the fiscal consolidation established in the 2012 SGP would entail greater corrective effort this year. Quite a likely scenario given the available figures for the third quarter of 2012.

In fact, public accounts accumulated a deficit of 65.31 billion euros in September last year or, in other words, 6.2% of the estimated GDP for the whole of the year. If we discount the FROB losses, which in the third quarter increased by 4.5 billion euros, this figure falls to 5.3% of GDP, 0.5 percentage points below the figure posted for 2011. Consequently, bringing the deficit down to the level demanded by the 2012 SGP would require a fiscal correction of 2.2 points of GDP in the fourth quarter. Although a large part of the effects of fiscal measures was concentrated into the last few months of the year, they might not be enough to achieve this goal. Our estimate therefore places the year-end deficit at 8.4% of GDP, compared with the target of 7.3%.

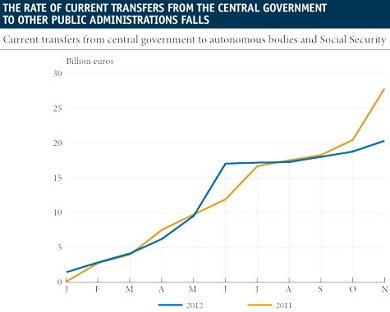

The latest data available point to the deterioration in the Social Security balance as the main reason for the deviation of the general government deficit in 2012. Social Security went from a surplus of 0.9% of GDP to a deficit of 0.2% of GDP during the third quarter. This trend is due to two factors. Firstly, the weak economic tone that is continuing to bring down revenue from Social Security contributions and push up unemployment benefit payments. Secondly, a significant drop can be observed in Social Security revenue from central government transfers in the third quarter. Specifically, a drop of nearly 10.10 billion euros compared with the previous quarter. As a result, the government deficit only grew by 0.3 percentage points during the same period, reaching 4.3% of GDP.

As can be seen in the graph above, this trend continued over the last few months of the year. For example, current transfers from the central government to Social Security and other autonomous bodies were down by 5.69 billion euros last November.

In addition to Social Security, the autonomous communities are also likely to deviate slightly from the target deficit set for 2012 as a whole. In spite of posting a deficit of 0.9% of GDP in the third quarter, a figure that is significantly lower than last year, a considerable proportion of annual expenditure is usually accumulated in the fourth quarter, so the deficit will probably end up above the target of 1.5% of GDP in 2012.

The risk premium demanded for Spanish debt, measured as the spread between the yields required for Spanish and German 10-year bonds, did not suffer from any significant tension during the last few months of the year. The Treasury took advantage of this opportunity to issue more debt to boost its reserves for 2013. This is good news considering the large number of bonds maturing for the public sector throughout the year. The Treasury’s debt maturities total almost 130 billion euros in 2013, of which just over half are bills. To this amount we also have to add the maturities of the Official Credit Institute (ICO), the Electricity Deficit Amortization Fund (FADE) and FROB, totalling around 20 billion euros, as well as those of the autonomous communities with an additional 14.7 billion euros.

Be the first to comment on "Spain’s deficit: new year, new goals"