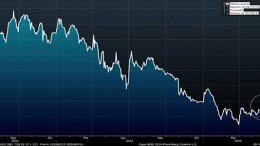

Biggest EU banks show poorest Q1 results in 5 years

MADRID | The Corner | The first quarter of the year is usually the best for lenders, and yet major European entities are showing the weakest results since Q1 2009: net profit fell once more (-9% yoy) to a pale EUR 12, according to a report by Deutsche Bank Research. Potentially high litigation costs and the upcoming ARQ and ECB’s stress tests make them eager to strengthen their capital buffers.